APA Corporation: Playing on the Edge

Short-Term Successes, Long-Term Risks, and Investor Outlook

Let’s talk about the energy sector, specifically about APA Corporation (Ticker: APA). This company has long established itself as a significant player in the exploration, development, and production of natural gas, oil, and NGLs. Their assets are spread across the globe: from the U.S. to Egypt, the North Sea, and Suriname. It’s impressive how they manage to balance operations across so many fronts! However, there’s a downside: a heavy reliance on oil and gas prices makes them vulnerable. But could we expect anything else in this industry?

Please read this:

Financial report Apa Corp

First, let’s look at the numbers:

1. Revenue

When you see a 15% revenue growth, it’s hard not to think that this company is far from standing still. APA Corporation earned $7.025 billion in the first nine months of 2024 — a billion more than the previous year. The main driver? Increased production of oil, gas, and NGLs. Sure, there were hiccups, like losses on derivatives, but that didn’t stop the company from gaining traction. Not to mention, the acquisition of Callon Petroleum clearly played a major role. The big question is: will this strategy prove sustainable in the future?

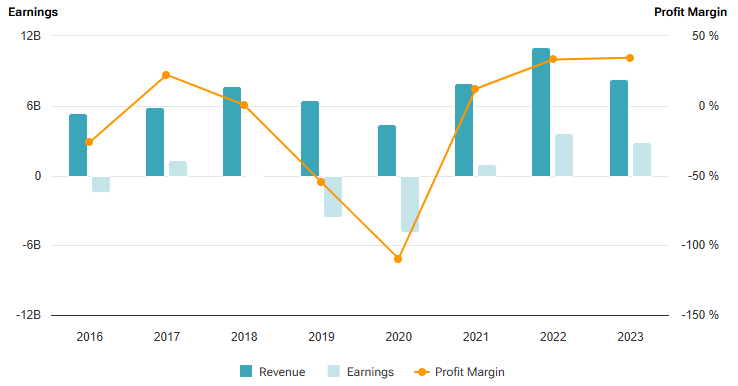

2. Profitability

The profit picture is less rosy. In 2023, net income was $1.082 billion, but now it’s only $450 million. What caused this drop? Impairments of $1.111 billion, including projects in the North Sea and the U.S., were a painful hit. Add to that higher depreciation expenses of $1.613 billion, and the puzzle pieces fall into place. It begs the question: what’s next for these assets?

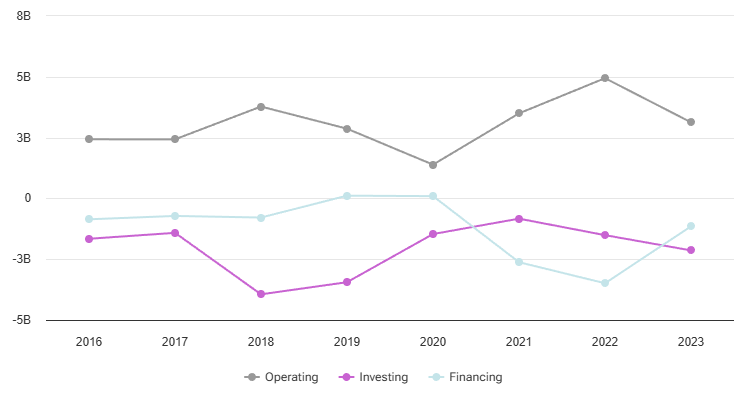

3. Cash Flows

Operating cash flow of $2.584 billion looks solid. But there’s a catch. Capital expenditures ($1.007 billion) and massive debt repayments ($1.6 billion) are devouring cash reserves. Can APA sustain this burden in the future, or will they need to cut spending?

4. Balance Sheet

The company’s assets jumped to $19.376 billion, primarily due to the Callon acquisition. But debt is keeping pace: long-term debt increased to $6.370 billion. Meanwhile, the company’s equity nearly doubled to $6.160 billion. On one hand, the assets are impressive; on the other, the hefty debt weighs heavily.

Short-Term Analysis

Last week showed decent performance — shares rose by 5.9%. But what’s next? Let’s break it down:

Resistance: $25.83. If the stock breaks this level, further growth could follow.

Support: $23.06. A drop below this level would be a bad sign.

Risks: RSI has already crossed 90. It’s like a red flag on the beach: things are overheated and need to cool off.

Strategy: If the price dips to $23.50, it might be worth considering. Entry at this level, exit around $25.80, and a stop-loss at $22.50 seems like a reasonable plan, doesn’t it?

Long-Term Analysis

Here, things get trickier. Oil prices are as unpredictable as April weather: sunny one day, rainy the next. APA’s revenues are tied to commodity markets, and that’s always a risk.

Valuation: A P/E ratio of 3.56 is like spotting a sale at a luxury store. But the projected EPS decline of 60.94% tempers enthusiasm.

Geopolitics: Operating in Egypt is like dancing on a volcano. It’s calm today, but who knows about tomorrow?

Dividends: They look stable now, but what happens if profits continue to fall?

Strategy: Consider buying if the price drops below $22. In the long run, $30+ could be realistic, but only if you’re ready for the risks.

Insider Sentiment

Insiders seem optimistic, buying more APA shares than they’re selling. In the last 100 transactions, 1.41 million shares were purchased, compared to 1.14 million sold. The most recent transaction was three days ago when Kimberly O. Warnica bought 46,000 shares. A higher number of shares bought suggests insiders see potential growth. However, large purchases could sometimes be tied to expiring stock options.

Risks to Consider

Price Volatility: Oil and gas prices can swing by double digits in a month.

Operational Issues: One disruption in Egypt could send revenues plummeting.

Debt: Post-Callon acquisition, the rising debt could become a problem.

Conclusion

Imagine you’re an investor who bought APA shares a year ago at $20.32. Today, they’re worth $25.09. Not bad, right? But what if oil prices had dropped? Such scenarios make you think: are you truly ready for the volatility?

I like this company’s potential. They’re leveraging synergies from the Callon acquisition, cutting costs, and focusing on key assets. However, their debt and the risks tied to commodity prices give me pause. This might be a case where diversification is key.

APA is a stock for those willing to embrace risk for high returns. They’re showing strong short-term momentum, but in the long run, much depends on oil price stabilization. If you’re prepared for the volatility and looking to ride a growth wave, APA could be a good choice. But as the saying goes, think for yourself, decide for yourself.