Bloomin Brands: A Turnaround in the Making or a Recipe for Disaster?

Diving into the Financial Realities of a Restaurant Giant: Can Strategic Moves Outweigh Mounting Challenges?

Financial Analysis of Bloomin' Brands Inc. — An Insider's View

When it comes to the restaurant industry, it’s hard not to notice how competitive the market is. But looking at Bloomin' Brands Inc. (NASDAQ:BLMN) , I can’t help but wonder: can they survive in such tough conditions?

Key Financial Indicators: Decline or Opportunity?

Let’s start with the numbers. For the first 39 weeks of 2024, the company earned $3.35 billion. Is that a lot or a little? At first glance — impressive. But in 2023, revenue for the same period was $3.48 billion. A $130 million drop — almost negligible for a giant of this scale. However, the net loss of $45.12 million, especially compared to last year’s profit of $208.86 million, raises questions. What went wrong? This isn’t just a decline; it’s a dramatic reversal.

Please read this first:

Financial reports Bloomin Brands

And here’s another unpleasant figure: EPS (earnings per share) plunged from $2.08 to negative $0.56. This isn’t just statistics. Imagine being an investor watching your portfolio tank. How would you feel?

Balance Sheet: Assets in Place, but...

At first glance, total assets increased: from $3.42 billion to $3.43 billion. Just $10 million more. But digging deeper, cash and equivalents dropped to $83.63 million — a serious warning sign. In 2023, they had $111.52 million. It turns out the company is losing liquidity before our eyes.

Liabilities are also on the rise. Total obligations grew to $3.19 billion, with a significant jump in long-term debt: from $780.72 million to $1.09 billion. The question is: how does the company plan to handle such debt?

Cash Flows: Where Is the Money Going?

Net cash flow from operating activities fell to $108.38 million compared to $373.55 million in 2023. This is a sharp decline. And while $198.67 million was spent on restaurant upgrades, one has to wonder: will this bring long-term benefits? Additionally, share buybacks of $265.70 million significantly depleted cash reserves. Isn’t this a risky strategy amid declining revenue?

Operational Metrics: What’s Happening in the Restaurants?

Sales declined across all company brands. Outback Steakhouse, the flagship brand, also came under pressure. Personally, I find this troubling. If the core segment is struggling, what’s left?

The closure of nine international restaurants — perhaps a strategic move. But impairment and closure costs amounted to $32.73 million. Will these expenses pay off?

Dividends and Buybacks: Caring for Shareholders or...

The company paid dividends of $0.72 per share for 2024. While the total amount was $62.21 million, the logical question arises: could this money have been reinvested? After all, the buyback of 10.07 million shares at an average price of $26.38 looks like an attempt to maintain market capitalization. But let’s be honest: investors aren’t altruists, and their patience has limits.

Risks and Challenges: Too Many Red Flags

Rising debt, declining demand, and currency fluctuations — this is just the tip of the iceberg. Currency impacts resulted in a cumulative loss of $70.74 million. Add to that decreasing consumer spending and high competition — and you get a cocktail of problems that could topple even the strongest player.

The Future: Hope or Illusion?

I feel Bloomin' Brands is trying to stay afloat through restructuring and optimization. Closing unprofitable restaurants is the right move, but is it enough? Investments in restaurant upgrades and technology are costly and long-term endeavors.

What Do I Think?

I can’t shake the thought that Bloomin’ Brands is standing on the brink of major changes. But do they have the resources? One figure alone — $1.09 billion in long-term obligations — makes me wonder: can they pull out of this nosedive?

If you’re an investor, now might not be the best time to buy shares. But if the company can execute its strategic initiatives, maybe a year or two from now we’ll see it in a completely different light.

Executive Summary

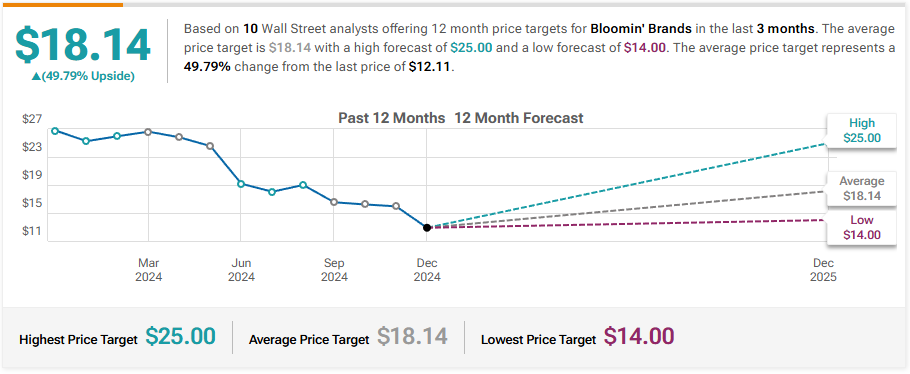

Current Price: $12.11

P/E Ratio: -151.38 (negative earnings)

52-Week High/Low: $29.43 / $11.24

Forward EPS: $1.90

Short-Term Signal: Weak (Sell)

Long-Term Signal: Risky (Hold for Turnaround Potential)

Company Overview

Bloomin' Brands, Inc. is a restaurant operator with popular concepts like Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill, and Fleming's Prime Steakhouse. The company is headquartered in Tampa, Florida, and focuses on casual and upscale dining experiences. While it operates internationally, its core revenue is derived from the U.S. market.

Investment Thesis

Valuation: BLMN is trading at $12.11, significantly below its 52-week high of $29.43. However, its negative P/E ratio reflects recent profitability challenges.

Fundamentals: Earnings have been negative, with trailing EPS at -$0.08. Operating margins are under pressure due to rising costs and weak same-store sales growth.

Growth Potential: Forward EPS of $1.90 indicates potential recovery, but this depends on aggressive cost management and revitalizing consumer demand.

Risk: High debt levels ($2.23 billion) and low cash reserves ($83.63 million) expose the company to liquidity risks. Operating in a highly competitive industry adds further pressure.

Risk Assessment

Liquidity Risk: BLMN has limited cash runway, with negative cash flow of $28.59 million over the last year.

Competitive Pressure: Stiff competition from other sit-down dining chains and fast-casual alternatives is eroding market share.

Economic Sensitivity: The restaurant industry is cyclical and sensitive to consumer spending trends, which remain fragile in the current environment.

Suggested Strategies

Short-Term (<1 Year)

Signal: Sell

Entry: Avoid buying until a clear reversal above $13.25 (resistance).

Exit: If holding, consider selling near current levels ($12.11) to limit exposure to downside risk.

Long-Term (1-3 Years)

Signal: Hold with caution

Entry: Buy only on dips near $11.24 (52-week low) if confident in management's turnaround plan.

Exit: Target $20-$25 if operational improvements materialize.

Valuation

PEG Ratio: 0.06 indicates the stock may be undervalued relative to its future growth, but this is contingent on execution.

Fair Value Estimate: Based on forward EPS of $1.90 and a modest 10x P/E multiple, a recovery could justify a $19 target.

Investing in BLMN requires understanding the risks of turnaround plays. The stock's depressed valuation may tempt value investors, but liquidity concerns and competitive challenges demand caution. Focus on management's ability to cut costs and boost demand while monitoring quarterly results for signs of stabilization. Patience is critical, and risk management should be your top priority.