Carnival: Growth Potential and Risks Ahead

An analysis of current opportunities and challenges for long-term investors.

Carnival (Ticker: CCL) is not just any cruise company. They practically rule the seas with their massive fleet. Brands like Carnival Cruise Line, Princess Cruises, and Holland America are well-known worldwide. What's interesting? The company does well when the economy is growing, but if the situation changes, they can face challenges. It's one of those cases where it's not just about investing but really understanding the details.

Read this first:

Financial report Carnival

I have a few friends who worked in the travel industry in the past, and they’ve told me that the cruise market was heavily impacted by the pandemic. But that’s behind us now, and recovery is in full swing.

Key Metrics (as of January 20, 2025)

Current Price: $25.85

P/E Ratio: 17.95

52-week High: $27.17

52-week Low: $13.78

PEG Ratio: 0.92 (indicates potential undervaluation relative to growth)

Short-Term Strategy

I’d enter the stock if it dips to around $24.50 — that’s a support level, and there’s potential for growth. Target? $27, which seems to be a reasonable resistance point for now.

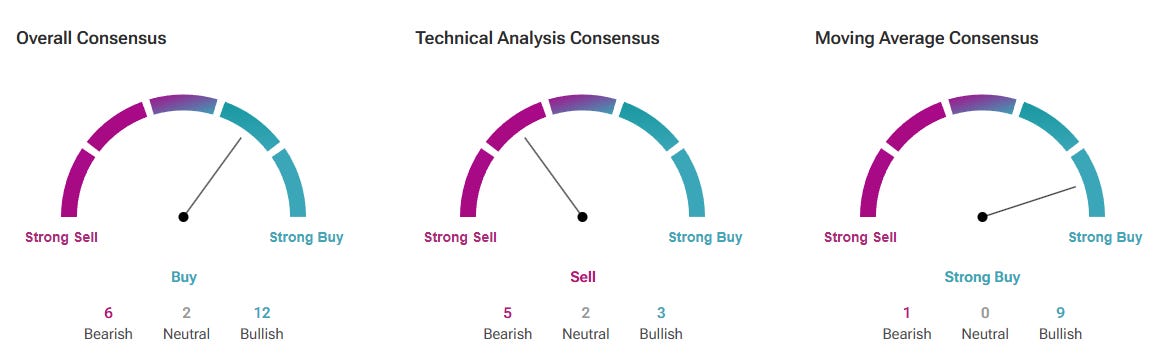

However, caution is key — the short-term momentum isn’t strong at the moment. Indicators like RSI and MACD suggest there could be a small decline before the price starts to climb again. Set a stop-loss at $23.50 to limit risks if the market goes against you.

Long-Term Strategy

If I’m being honest, I think there’s a good case for Carnival in the long run. People are traveling again, and the cruise industry is bouncing back strong. The projected earnings of $1.72 per share next year sound pretty solid. Plus, with a PEG ratio of 0.92, the stock could be undervalued, which, in my mind, means there’s potential for growth. Over the next year or two, I wouldn’t be surprised if the stock reaches somewhere between $30 and $35.

However, there are risks as usual. Prices may decline if the economy stalls once again, as it occurred in 2023. However, growth should continue as long as things remain stable.

It’s impossible to predict exactly how the market will behave, so there’s always an element of uncertainty. But if the economy holds up, Carnival could definitely meet expectations.

Risk Factors

There’s no escaping the debt. $25.94 billion — those are serious numbers. While the company is trying to reduce its debt, there are still risks, especially with economic uncertainties.

Carnival is also very sensitive to economic cycles. If people start spending less on vacations, that will directly affect revenue.

Investment Position

I’m optimistic about Carnival, but with caution. The company’s forecasts and numbers are solid, but the debt and economic dependence mean I’ll be keeping an eye on it. For long-term investors, this could be a great option, but remember that things can change quickly.

Revenue

Carnival appears to have taken a big step forward. Compared to just $16.20 billion for the same period last year, they made $19.08 billion for the first nine months of 2024. That is an increase of 18%! Why is this happening? Clearly, the rebound in demand for travel has contributed significantly, and travelers are spending more money while traveling. I can't help but think that they're coming back when I look at this. For investors who are still undecided, this will be a clear indication if things keep going this way.

Forecast: Demand for cruises is still increasing, and revenue is likely to continue rising in the upcoming year. The huge "but" is that everything is dependent on price and the state of the economy as a whole.

Profitability

After a $26 million loss in 2023, the company's net profit for the first nine months of 2024 was $1.61 billion. Now, that is just amazing. However, there are certain obstacles. For example, there is still anxiety about growing interest costs and operations expenses like fuel and staff. In the future, these problems might keep eroding Carnival's profitability.

Cash Flow

Here’s where they really shine: cash flow from operations increased to $5.01 billion, compared to $3.36 billion last year — almost a 50% increase! That’s quite something. But let’s not forget, a large portion of this money is being used to invest in new ships. It looks promising, but the key will be whether the company can generate sustainable profits after these investments.

Balance Sheet

Carnival’s total assets amounted to $49.81 billion, of which $3.63 billion were current assets. Total debt stands at $29.64 billion, with long-term liabilities making up $26.64 billion. Yes, the debt load is high, but if revenue keeps growing, they should be able to manage it. Also, shareholders’ equity grew to $8.60 billion, which is a positive sign given the improvements and retained earnings.

Growth Areas

Travel Recovery: The post-pandemic worldwide travel boom is helping Carnival.

Fleet Expansion: Purchasing new, environmentally friendly ships is a wise investment.

International Markets: It's important to note the revenue increase in Australia and Europe.

Insiders are Positive Buying More Shares Than They Are Selling In Carnival

In the last 100 trades there were 2.53 million shares bought and 610.7 thousand shares sold. The last trade was made 83 days ago by Band Sir Jonathon who sold 17.5 thousand shares. The large amount of stocks bought compared to stocks sold indicate that the insiders believe there is a potential good upside. In some cases larger purchases can be explained by due date for stock options.

Risks and Challenges

Economic Sensitivity: A slowdown in the economy will hurt Carnival’s performance.

Debt Load: High debt continues to be a significant limitation.

Regulatory Risks: Stricter environmental regulations, such as the EU emissions trading scheme (ETS), could increase operating costs.

Competition: The cruise industry is highly competitive, which puts pressure on pricing and profitability.

My Opinion

Carnival seems to be heading in the right direction with its recovery, but I can’t ignore the whale in the pool: the high debt. That’s a big concern for me, especially since the company’s fortunes are tied to the economy’s ups and downs. For long-term investors, though, I think there’s definitely an opportunity here — if you’re patient and willing to ride out any bumps along the way. But keep in mind, if the economy takes a hit, it could hurt the stock. The trick is to get in at the right price, so you’re not exposed to unnecessary risk.