Celsius Holdings: The Power of the Brand and Growth Potential

Financial performance and growth prospects of the company amidst competition.

Have you ever wondered why energy drinks are so popular these days? Celsius Holdings (Ticker: CELH) seems to have cracked the code for blending fitness, health, and energy into one can. Their products target people who want it all—energy for workouts and a healthier lifestyle. And they’re selling these drinks worldwide: from the U.S. to Europe and Asia. But let’s look behind the shiny cans and see what’s really going on.

Read this first:

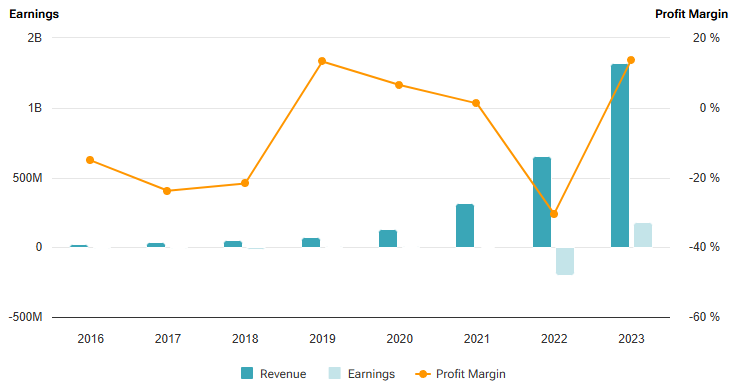

Financial report Celsius

Partnership with PepsiCo: Opportunity or Trap?

One of Celsius’s biggest advantages is its partnership with PepsiCo. On one hand, it opens doors to shelves and fridges globally. But what happens if PepsiCo decides, “We’ve got this on our own”? Nearly 54% of Celsius’s revenue depends on PepsiCo. Isn’t that a little too much? It’s like in life—leaning too heavily on a friend can be risky.

Numbers That Make You Think

Current Price: $26.87

P/E Ratio: 37.32 – way higher than the industry average.

52-Week High/Low: $99.62 and $25.23 – talk about a rollercoaster!

EPS Growth: projected at 36.11%.

PEG Ratio: 1.03 – looks fair, but only if growth holds steady.

What Do the Charts Say?

Celsius’s stock has tumbled from its yearly high and is now hovering near its low. The RSI is at 49.26—neutral territory. Support sits at $25.64, resistance at $30.27. Honestly? Unless it breaks above $30, it’s better to sit this one out. The situation feels too uncertain. Who wants to gamble?

What About Long-Term Potential?

The energy drink market is booming, and Celsius has a shot at carving out its own "healthy" niche. But the company’s future depends heavily on PepsiCo and its ability to expand internationally. With a P/E of 37.32, the stock feels pricey. The PEG ratio suggests it’s fairly valued, but that only holds true if growth stays on track.

My advice? If you're thinking long-term, aim to buy around $25. Otherwise, the risks might outweigh the rewards. I think you could sell in a couple of years for $40–$50 if things go as planned.

What Does the Report Say?

Revenue

Let’s start with the big question—how much money is Celsius making? For Q3 2024, revenue came in at $265.75 million. At first glance, that’s impressive, but here’s the catch: last year, during the same period, it was $384.76 million! That’s a nearly $120 million drop—makes you pause and think, doesn’t it?

Now, zooming out a bit, the nine-month revenue for 2024 reached $1.02 billion, up from $970.58 million in 2023. A positive sign, no doubt.

Here’s an interesting tidbit: over half—53.5% to be precise—of total revenue comes from PepsiCo. On one hand, that’s a solid partnership. On the other, it’s a bit of a red flag. Relying so heavily on one client could backfire.

Profitability

The gross margin is sliding, and that’s undeniable. It was 50.4% a year ago but has now dropped to 46% in Q3 2024. Digging deeper, net income for the nine months has also taken a hit, coming in at $163.95 million compared to $176.69 million in 2023.

And what about operating losses? Here’s where it gets messy: a $3.21 million operating loss in Q3. The culprit? Skyrocketing expenses for marketing and administrative operations.

It’s like a story with two plots: one about strong growth and potential, the other about risks and shrinking margins.

Cash Flow

Now for the good news. Despite these challenges, operating cash flow is on the rise—$187.23 million for the first nine months, compared to $136.05 million last year. The company also has plenty of cash on hand—$903.75 million as of September 30.

Balance Sheet

Celsius’s financial health seems solid. Total assets grew to $1.7 billion, liabilities stand at $456.21 million, and equity jumped to $423.63 million—a noticeable increase from $264.04 million last year. Stable balance sheet? Definitely.

Risks? There Are Plenty.

Legal Issues: What if they get accused of misleading marketing? It's not unheard of.

Rising Costs: Marketing and advertising aren’t cheap. It’s like trying to keep everyone’s attention at a party—it takes more and more effort.

Competition: Monster and Red Bull are tough rivals.

Economy: If consumers start cutting back, energy drinks might not top their shopping list.

Insiders are Negative Selling More Shares Than They Are Buying In Celsius Holdings, Inc

In the last 100 trades there were 10.31 million shares bought and 26.12 million shares sold. The last trade was made 14 days ago by Watson Kyle Audrey who sold 5.58 thousand shares. In general the insiders are selling more stocks than they buy. There can be a variety of reasons for this, but in general it can be considered as a negative signal.

My Take?

At the end of the day, Celsius is a tough player. The company is sitting on a mountain of cash, partnering with giants like PepsiCo, and aiming for international expansion. But the declining quarterly revenue and profitability are cause for concern.

Could this company be a good investment? Quite possibly. But I’d hold off for now. If revenue growth stabilizes in the coming quarters and expenses come under control, it might be worth a serious look.

Investment Decision: Keeping it on the watchlist. For now, buying seems like playing with fire.

DANGER ZONE

Current Price: $26.87

P/E Ratio: 37.32 (high relative to the industry average)

52-Week High/Low: $99.62 / $25.23

Growth Rate: 36.11% projected EPS growth

PEG Ratio: 1.03 (fairly valued based on growth)

Short-Term Analysis

Momentum: The stock has been in a sharp decline from its 52-week high, trading near its lows. RSI at 49.26 suggests neutral momentum.

Technical Levels: Resistance at $30.27 and support at $25.64. A break below support could lead to further downside.

Recommendation: Avoid short-term entry unless it breaks above $30 with volume. High volatility and declining sentiment make this risky.

Long-Term Analysis

Growth Potential: The energy drink market is expanding, and Celsius has a niche in health-conscious beverages. Long-term growth is tied to maintaining its partnership with PepsiCo and scaling internationally.

Valuation: At a P/E of 37.32, the stock is expensive relative to its peers. However, the PEG ratio of 1.03 suggests fair valuation if growth is sustained.

Risks: Heavy reliance on PepsiCo for distribution is a double-edged sword. Competitive pressures from established players like Monster and Red Bull remain significant.

Recommendation: Long-term investors should consider entry near $25. Target price over 2-3 years: $40-$50 if growth metrics hold.

Risks to Consider

Legal challenges around inventory overselling and misleading sales practices could weigh on sentiment.

Profit margins are under pressure due to aggressive promotional pricing and elevated marketing expenses.

A broader economic slowdown or reduced consumer discretionary spending could hurt growth.

Investment Strategy

Entry Point: Consider buying near $25 support level for long-term positions.

Exit Point: Target $40-$50 over the next 2-3 years if growth stabilizes.

Stop-Loss: Exit below $24 to minimize downside risk.