Disney and Fubo: A Union of Content and Sports

Family entertainment and thrilling sports streaming – everything you need on one platform.

Disney (Ticker: DIS) is set to merge Hulu + Live TV with Fubo (Ticker: FUBO). What do the leader in family entertainment and a sports streaming platform have in common? Let’s dive in.

Please read this first:

Financial reports Walt Disney Co

Financial reports FuboTV Inc.

First, after the deal, Disney will own 70% of the combined company, which will remain public and retain the name "Fubo." The current Fubo team, including CEO David Gandler, will continue to manage the company. Predictable, but what does this mean for us, the viewers? According to the companies, it means more flexibility in content selection. But is that enough to attract subscribers already spoiled by the variety of streaming platforms?

The key takeaway: the combined company will have 6.2 million subscribers in North America. Sounds impressive, but on closer inspection, how easy will it be to retain this base, especially with growing competition and rising subscription costs? Disney is betting on its proven assets, including ESPN, ABC, and Disney+, to provide exclusive content and attract more viewers. But will that be enough?

Now to the financial aspect. Disney is investing not just assets but also cash into this deal. They provided a $145 million term loan to support the new company and allocated $220 million to settle all litigation with Fubo, Warner Bros., and Fox. But here’s the catch: Fubo is clearly facing challenging times.

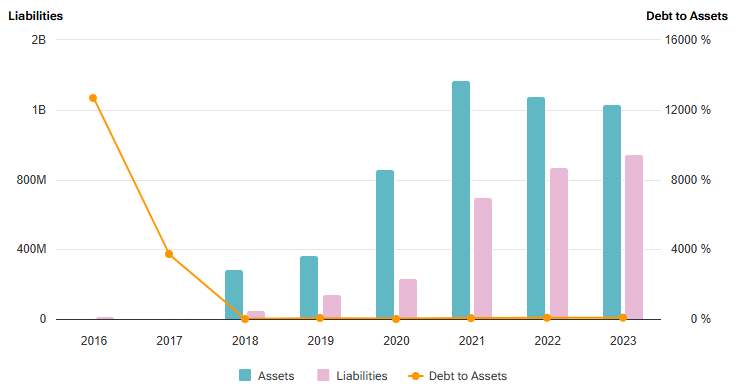

As of September 30, 2024, Fubo’s assets had shrunk to $1.1 billion, while liabilities still amounted to $880 million. Cash reserves nearly halved to $146 million. Meanwhile, its convertible debt remained at $332 million. That’s a significant burden for a company with ongoing operational losses.

Speaking of revenue, Fubo’s is growing at a healthy pace—up 23% year-over-year to $1.179 billion, largely driven by subscription revenue, which reached $1.093 billion. However, expenses are rising even faster. Operating costs hit $1.337 billion, and net losses totaled $135 million for the first nine months of 2024. While this is better than the $217 million loss a year earlier, it still raises questions about financial stability.

Now let’s look at Disney. This company is synonymous with stability and strong financial performance. Its revenue for 2024 reached $91.36 billion, up 2.8% from the previous year.

Parks and resorts continue to deliver steady income, with assets in this segment growing to $37.04 billion. However, Disney’s expenses are substantial too. Restructuring costs amounted to an impressive $3.6 billion, likely tied to business reorganization in response to competitive pressure.

Another key point is Disney’s debt load. Its borrowings decreased from $46.43 billion to $45.81 billion, a positive sign for investors. However, cash reserves nearly halved, dropping from $14.23 billion to $6.1 billion over the year. This could indicate significant spending on development and competitiveness.

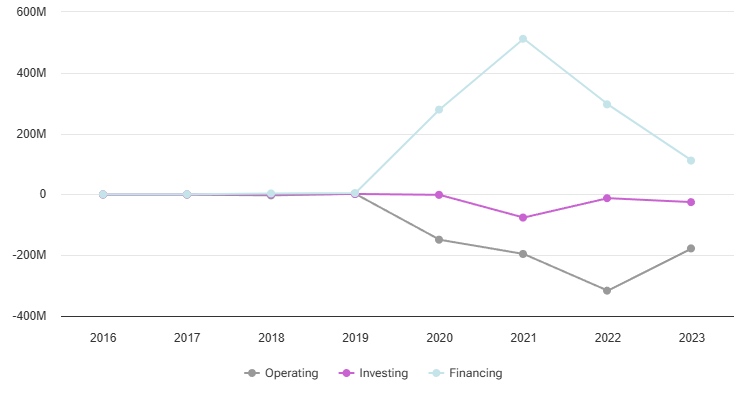

Back to the merger: it appears to be Disney’s attempt to expand its presence in virtual TV by leveraging Fubo’s strength in sports streaming. Meanwhile, Fubo gains access to Disney’s powerful media resources, including brands like ESPN and ABC. This is a strategically strong move, but the risk lies in whether the new partners can handle financial challenges. For example, Fubo reported a negative operating cash flow of -$96.5 million for the nine months ending in September 2024. This forces the company to rely on external financing, which always carries risks.

The big question is: is the risk justified? Disney is betting on growing its subscriber base and expanding its programming offerings. But can they achieve these goals given Fubo’s high expenses and Disney’s shrinking liquidity? Or will this become yet another costly attempt to reshape the streaming industry?

This deal seems like a long-term gamble. Yes, the combined company will offer more content, more flexibility, and even new sports channels to viewers. But honestly, this might not be enough if Fubo’s financial troubles start affecting the operational performance of the merged entity.

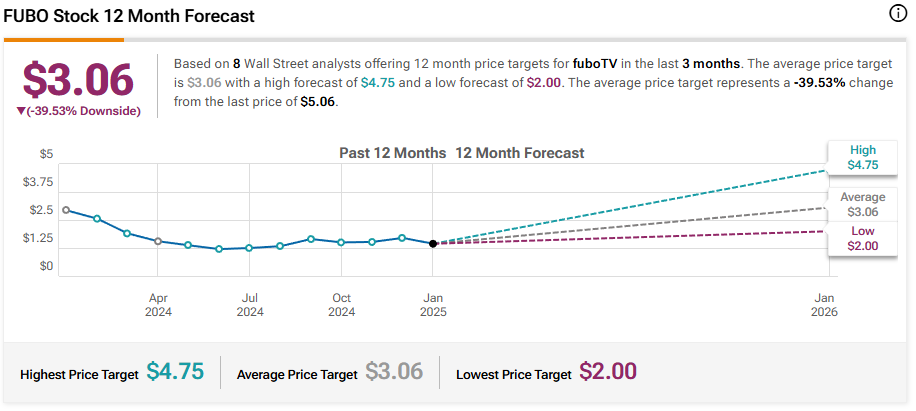

In this context, it all boils down to this: we see a bold but risky bet by Disney. If everything goes according to plan, the merger of Hulu + Live TV and Fubo could mark a new milestone in the streaming industry. But if not, we might witness another restructuring in a few years. So, is it worth the risk for investors? Well, the answer depends on your risk tolerance.

The Walt Disney Company (DIS): Investment Analysis

Key Stock Metrics

Current Price: $111.05

P/E Ratio: 40.83 (expensive relative to peers)

Forward EPS: $5.15

52-Week High/Low: $122.63 / $83.54

PEG Ratio: 0.46 (indicating growth potential)

Current Market Sentiment

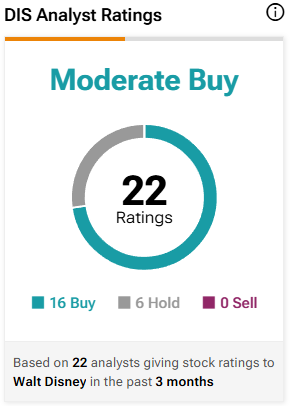

Disney's stock is underperforming, trading near its lower Bollinger Band ($109.48), suggesting potential oversold conditions.

RSI at 40.13 indicates neutral-to-weak momentum. This is not yet a clear buy signal but worth monitoring.

The upcoming earnings release on February 5, 2025, could significantly impact the stock's direction.

Investment Thesis

Disney is a fundamentally strong company with a diversified revenue base. However, its current valuation of a P/E ratio of 40.83 is rich, especially in a high-interest-rate environment. The streaming wars are squeezing margins, and theme park revenue remains sensitive to economic conditions. The PEG ratio of 0.46 suggests solid growth potential, but investors should be cautious of execution risks in the streaming business and global economic uncertainties.

Suggested Strategies

Short-Term: Enter near $109 (support level). Target $116 (resistance). Stop-loss at $107 to minimize downside risk.

Long-Term: Hold for 35 years if acquired below $110. Leverage growth in streaming and recovery in park revenues. Exit above $140 for a 25%+ gain.

Risks

High competition in streaming (Netflix, Amazon) could erode market share.

Economic downturns may hurt discretionary spending on theme parks and merchandise.

Elevated debt levels limit flexibility for acquisitions or new ventures.

Key Takeaways

Disney remains a strong long-term investment but is currently priced for perfection. Short-term traders can exploit volatility around earnings, while long-term investors should focus on accumulating during pullbacks. Always manage risk with stop-loss orders and position sizing.