Intel at a Crossroads: Can Leadership Changes Restore Its Dominance?

A focus on artificial intelligence and large-scale restructuring bring hope, but can these measures overcome financial struggles and the growing gap with competitors?

Intel Corporation (NASDAQ: INTC) has taken a dramatic step in restructuring its leadership. CEO Pat Gelsinger recently stepped down, with David Zinsner and Michelle Johnston Holthaus named as interim co-CEOs. This move signals Intel’s urgent attempt to recover its stature in the technology industry and reassure investors following its exclusion from the Dow Jones Industrial Average (DJIA) after being surpassed by NVIDIA Corporation.

Key Financial Developments

Despite these leadership changes, Intel is sticking to its current strategy and financial guidance. For Q4 2024, the company forecasts revenues between $13.3 billion and $14.3 billion, and non-GAAP earnings per share (EPS) of $0.12. However, Q3 2024 painted a grim picture: revenue dropped 6% year-over-year to $13.3 billion, while gross margins fell from 42.5% in Q3 2023 to 15%. This decline was due to impairment charges and accelerated depreciation related to manufacturing assets, particularly for the Intel 7 process node, amounting to $3.1 billion in non-cash costs.

Net losses for the quarter totaled $16.6 billion, exacerbated by $2.8 billion in restructuring costs and a $9.9 billion valuation allowance against deferred tax assets.

The AI Push: A Double-Edged Sword

Intel has heavily invested in AI chips for data centers and personal computers, signaling a shift in its focus. The introduction of the Intel Core Ultra series with enhanced AI capabilities, offering 2.5 times more energy efficiency, underscores its commitment to AI-driven growth. Additionally, the company launched the Gaudi 3 AI accelerators, targeting enterprise-level AI applications.

However, Intel lags behind NVIDIA in the AI hardware market. NVIDIA’s GPUs, particularly the H100 and Blackwell models, dominate the market and are critical for AI workloads. Intel’s AI-focused investments have increased production costs and squeezed margins, especially after moving production to higher-cost facilities in Ireland.

Operational Challenges

Intel continues to face significant operational and competitive hurdles. Its margins remain under pressure due to unfavorable product mixes, unused manufacturing capacity, and restructuring costs. The company reported a $5.8 billion operating loss for its foundry business in Q3 2024, highlighting inefficiencies in its new internal foundry model. These challenges, coupled with stringent export restrictions and intense competition from Advanced Micro Devices (AMD) and NVIDIA, have made recovery even more difficult.

Market Sentiment and Stock Performance

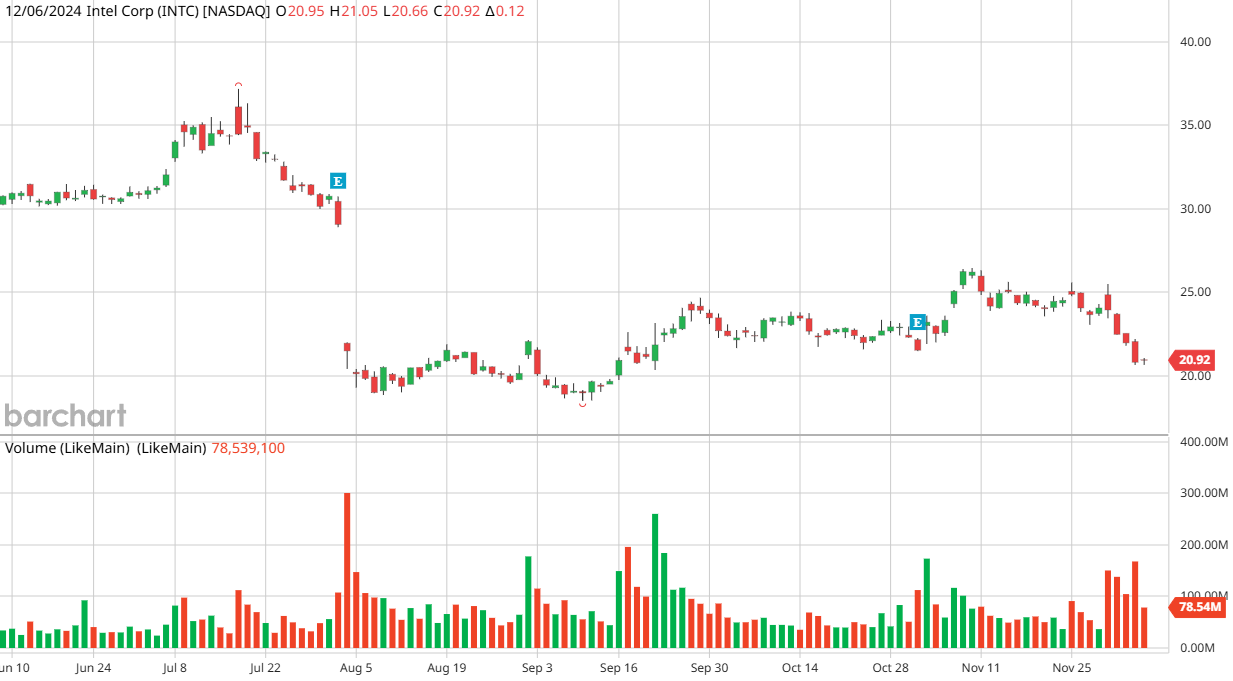

Over the past year, Intel’s stock price has dropped by 46.8%, starkly contrasting with the semiconductor industry’s 152.8% growth, as competitors like AMD and NVIDIA thrive. This underperformance has compelled Intel to consider bold moves, such as spinning off its foundry division into a separate entity to attract external funding and improve efficiency.

Conclusion

Intel is navigating a challenging transformation period. While its AI-focused product launches and cost-cutting measures could eventually bear fruit, the company faces a steep uphill battle to regain investor confidence and market share. The combination of financial losses, operational restructuring, and intense competition underscores the significant risks ahead.

Intel’s leadership reshuffle and strategic pivots will need to deliver tangible results quickly to stabilize its position in the fast-evolving semiconductor market. Until then, investor skepticism is likely to persist.