Kinross Gold (KGC): Mining Gold or Mining Profit?

Surging revenue, record cash flows, and correction risks.

A Canadian gold mining business, Kinross Gold Corporation (Ticker: KGC) has holdings in the United States, Brazil, Chile, Mauritania, and other countries. On the surface, it appears to be a traditional tale: find gold, extract it, and then sell it. But gold mining involves more than just shovels and glittering nuggets; it also involves how a business handles its resources, overcomes obstacles, and adjusts to shifting market conditions.

Read this first:

Financial report Kinross Gold Corporation

Key Metrics: The Numbers You Need to Know

52-week range: $4.69 – $12.02

P/E ratio: 19.75

Forward earnings per share: $0.88

PEG ratio: 0.42 (hinting at high growth potential)

Revenue: Gold Prices Rise—So Does Revenue

In Q3 2024, Kinross posted impressive growth: revenue surged 30% to $1.432 billion (compared to $1.102 billion a year earlier). What was the main driver? Simple math: the average gold selling price increased by 28%, from $1,929 to $2,477 per ounce. Investors tracking gold understand that the precious metals market is like a seesaw—up today, down tomorrow.

Profitability: Numbers That Make Us Happy

When analyzing a company, I focus primarily on profitability, and here, there’s a lot to discuss.

Operating profit soared by 142% (from $226.2 million to $547.7 million).

Net income tripled—$355.3 million vs. $109.7 million a year ago.

Earnings per share (EPS) jumped from $0.09 to $0.29.

The big question: Can Kinross maintain this pace, or is this just a temporary effect of high gold prices?

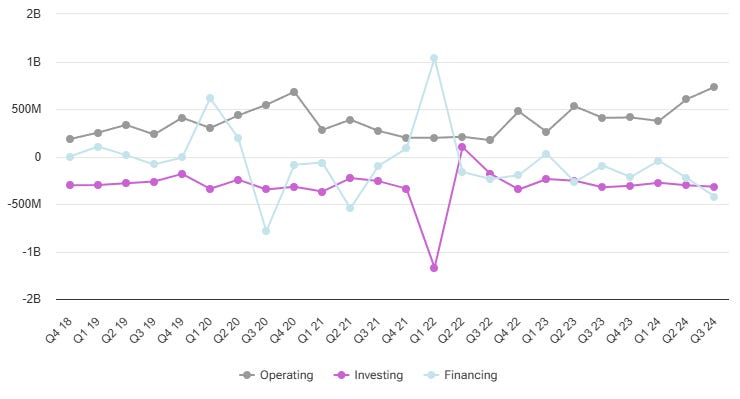

Cash Flow: More Important Than Profit?

If you're an investor, you know that "paper" profit doesn’t always reflect a company's financial health. Cash flow is far more important. And Kinross is doing well in this regard:

Operating cash flow nearly doubled—$733.5 million vs. $406.8 million a year ago.

Free cash flow reached $414.6 million, three times more than in 2023 ($137.7 million).

For comparison, in 2022, the company posted a modest $187 million in free cash flow. This suggests that growth isn’t just a fluke but a trend—something investors would like to believe.

Balance Sheet: Strong Liquidity

Kinross will release its annual results on February 13, but as of September 30, 2024, its financial position was as follows:

Cash reserves: $472.8 million (up from $352.4 million a year earlier).

Credit facility: $1.65 billion.

Total liquidity: Around $2.1 billion.

Sounds good, but what about debt? The debt level is still manageable, but in the mining business, debt often increases as projects expand.

KGC is already near its yearly peak.

Short-Term Strategy: Playing the Momentum

Buy signal: The stock is rallying, with an RSI of 70.74—a nearly overbought market. Does this mean it's time to buy? Not necessarily. Yes, the bullish trend is evident, but history has many examples of strong rallies followed by corrections.

Optimal entry point: If the price cools down slightly (to $11.50), it could be a good entry. The support zone of $11.40–$11.50 looks solid.

When to take profit? Target: $12.00–$12.20. It may not sound like a massive move, but for active trading, it’s ideal.

At the end of 2024, we saw a similar scenario with Barrick Gold (GOLD)—an RSI of 72, the stock at its yearly high. It seemed poised for a breakout but instead dropped 5% in just a few days. KGC could follow the same pattern, so chasing the price is not the best idea.

Long-Term Strategy: Playing the Long Game

Buy signal: A PEG ratio of 0.42 suggests the stock is undervalued. Add to this increasing production volumes and strong management, and long-term entry looks appealing.

Entry point: If the price dips below $11.00, start accumulating a position—especially if the correction is due to overall market panic rather than company-specific problems.

Exit target: $15.00–$16.00 over 12–18 months.

Is this realistic? Yes—if gold prices continue rising and Kinross manages its costs wisely.

Why KGC Could Be a Solid Investment?

Valuation: P/E 19.75, PEG 0.42—for a gold miner, this is quite attractive, especially given EPS growth of 46.67%.

Risks:

Gold price dependency. If gold drops, so will KGC stock. History has seen periods where gold fell below $1,500 per ounce.

Political instability. Mauritania, Chile—not the most stable regions. What if sanctions hit? What if governments change? Meanwhile, Canadian projects like Great Bear require complex permitting, which could delay production timelines.

Rising costs. Production costs rose by 7%—from $911 to $976 per ounce. If industry-wide inflation continues, margins could shrink.

How Would I Minimize Risks?

Monitor gold prices. If prices drop sharply, reduce exposure.

Watch political events. A sudden law change in a mining country could disrupt operations.

At $10.50, set a stop-loss. Leave with as little loss as possible if things go wrong.

In conclusion, should I buy?

Kinross currently appears appealing because to its solid financials, significant cash flow, and upcoming projects that may boost production. But it's important to keep in mind that this is a commodity company, and fluctuations in the price of gold have the power to alter all expectations.

KGC may easily reach $15.00+ if gold continues to rise.

If not, Kinross has the balance sheet to wait it out, but patience will be needed.

KGC is an intriguing choice if you're searching for a stock that might profit from a sustained gold bull market. However, you should keep a careful eye on price levels and gold price movements if you like more secure investments.

Although, as they say, "not all that glitters is gold," Kinross now has a very alluring appearance.