Lyft: Eternal Underdog?

Profitability, ride growth, and buybacks—can Lyft stay afloat in the battle against Uber?

Lyft Inc. (Ticker: LYFT) one of the Key Players in the Ridesharing Market in the U.S. and Canada. The company has long competed with Uber, but it has its own unique edge: a more friendly service, faster car arrival times, and a focus on customer loyalty. Some even joke that Lyft is Uber for those who want to support local services.

Read this first:

Financial report Lyft Inc.

Revenue: Business is Growing, But for How Long?

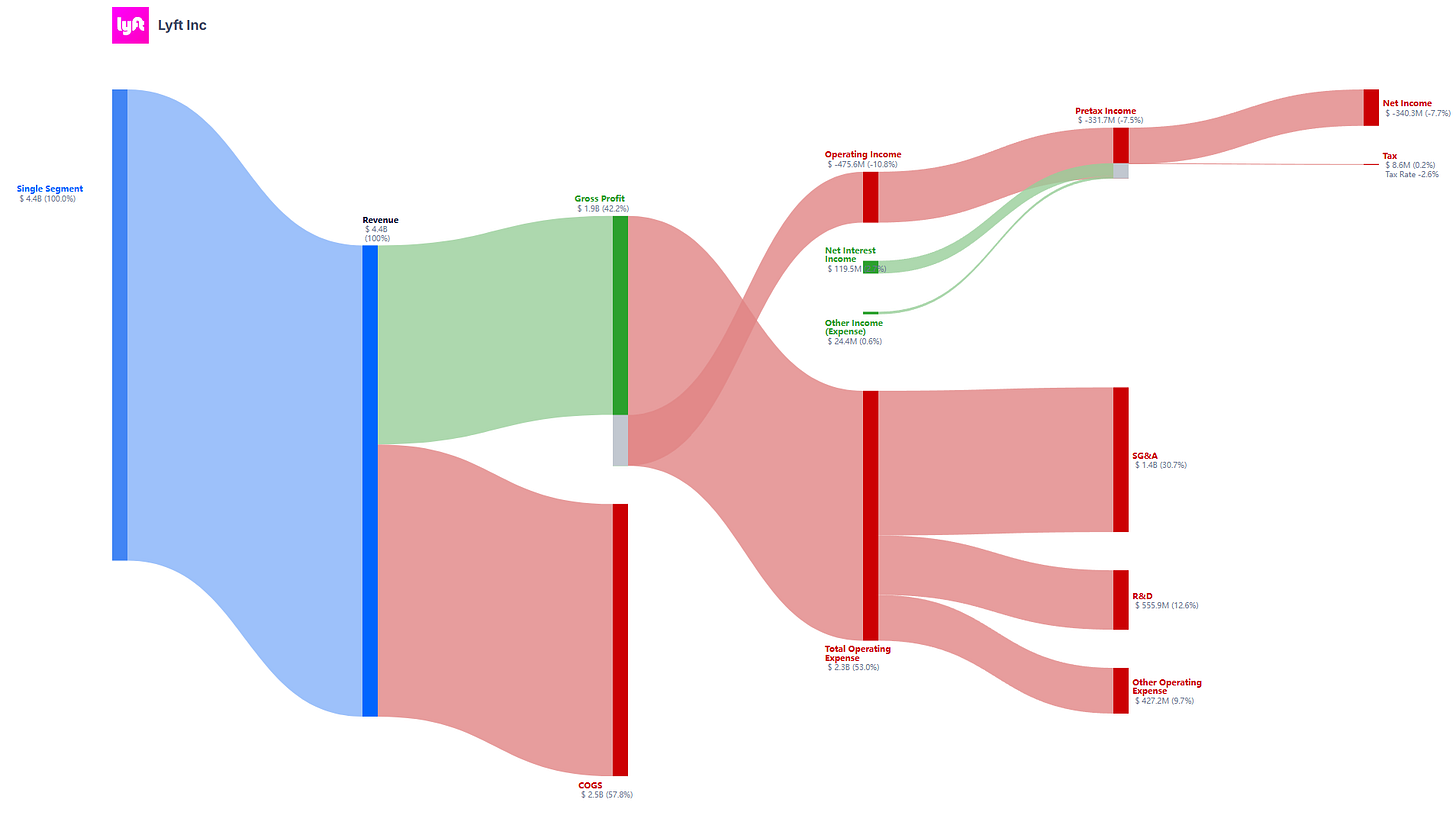

In 2024, the company generated $5.8 billion in revenue, a 31% increase compared to 2023. The fourth quarter brought in $1.6 billion (+27% YoY). The forecast for Q1 2025 suggests gross bookings growth of 10-14%. However, it’s important to note that this growth is largely driven by an increase in the number of rides (+17% YoY) and the expansion of the active user base (44 million). The real question is: will this be enough to compete sustainably with Uber? Considering the stock decline after the earnings report, I have my doubts.

Profitability: Finally in the Black!

For the first time in its history, Lyft posted a GAAP net profit of $22.8 million (compared to a loss of $340.3 million a year earlier). Adjusted EBITDA margin also improved to 2.4% (from 1.6% in 2023). Of course, compared to Uber, this is just a drop in the ocean, but for Lyft, it’s a real breakthrough. As the saying goes, better late than never.

Cash Flows: Money is Finally Flowing in the Right Direction

Operating cash flow reached $849.7 million (compared to -$98.2 million in 2023). Free cash flow also turned positive at $766.3 million (versus -$248.1 million a year earlier). This is a strong signal that the business has become more stable. However, the key question remains: can they maintain this momentum?

Balance Sheet: Cash is There, But So Are Liabilities

Lyft currently has $759 million in cash and $1.23 billion in short-term investments. However, total liabilities amount to $4.67 billion, including $565 million in long-term debt. While the company is not drowning in debt, it has limited room for large-scale investments.

Growth Areas: There’s Potential, But It’s Not That Simple

Rides and Market Share: In 2024, the number of rides grew to 828 million (+17% YoY), and Lyft’s preference over Uber increased by 16 percentage points in Q4 2024. This is a good sign, but it’s important to remember that Uber remains the global leader.

Technology: The company is actively investing in AI, driver-matching algorithms, and new passenger features. Will this be the key to growth? Possibly.

Stock Buyback: The board has approved a $500 million share buyback program. This could support stock prices in the coming months. However, I see this as a negative signal—if a company doesn’t know where to invest, it starts buying back its own shares from the market.

Risks: It’s Not All Rosy

Uber isn’t going anywhere. It’s stronger, wealthier, and bigger in scale. Lyft remains a niche player.

Profitability is under pressure. Yes, they finally posted a profit, but it’s still tiny.

Regulation. Potential changes in labor laws regarding driver employment could increase company costs.

Market volatility. The recent stock drop shows that investors aren’t fully confident in Lyft’s future.

Insiders Are Bearish

Over the last 100 transactions, 1.28 million shares were bought, while 1.78 million were sold. The last transaction was made 23 days ago by Janey Whiteside, who purchased 997 shares (LoL).

My Opinion: Is It Worth Buying?

On one hand, Lyft looks more attractive than it did a year ago. The company has turned profitable, cash flow has improved, it is investing in technology, and it’s even buying back shares. On the other hand, Uber remains a giant that can easily outcompete Lyft with pricing strategies and services.

Trade Idea:

If Lyft's stock stabilizes around $12.50–$13.00 and reversal signals appear (increasing buying volume, a bullish pattern), it may be worth considering a buy with a target of $14.50–$15.00. Stop-loss: below $11.00.

Lyft is a company with growth potential, but risks remain. For long-term investors, there are too many uncertainties. However, for short-term trades, it could be a viable opportunity—especially if you can enter at a good price. The main thing to remember: Lyft is not Uber, and it’s unlikely to ever become one.