The release of the January Consumer Price Index (CPI) raised concerns among stock market participants and Treasury bond investors. However, the subsequent release of the Producer Price Index (PPI) for the same period did not add new inflationary worries. Although some indicators did not meet optimistic expectations, the market is betting on the upcoming PCE index, which is set to be published on February 28, as a key indicator that could confirm or dispel potential inflation risks.

Certain PPI components, such as airfare and medical services, declined, which had a positive effect on debt instruments and contributed to stock market growth. At the same time, the drop in initial jobless claims to 213,000 indicates a stronger labor market than expected, which could reinforce the Federal Reserve's hawkish stance.

Divergent Corporate Sector Results

February corporate earnings reports presented a mixed picture. Among the growth leaders were:

MGM Resorts International (+17%) – strong quarterly revenue contributed to a significant rise in stock prices.

Molson Coors Beverage Co (+9%) – profit figures exceeded forecasts.

GE HealthCare Technologies (+8%) – beat expectations in adjusted earnings and provided an optimistic forecast for 2025.

However, there were also disappointments:

Datadog (-8%) – weak earnings forecast for 2025 and a negative rating revision from Wells Fargo put pressure on the stock.

Deere & Co (-2%) – lowered production forecast and weak precision agriculture results led investors to reassess the company’s prospects.

European Markets and Their Influence on the U.S.

The surge in European stocks to a 25-year high provided additional support for the U.S. stock market. This was driven by hopes of a possible diplomatic resolution to the Ukraine conflict following negotiations between the U.S. and Russia. Improvement in the geopolitical landscape could potentially reduce risks for global investors.

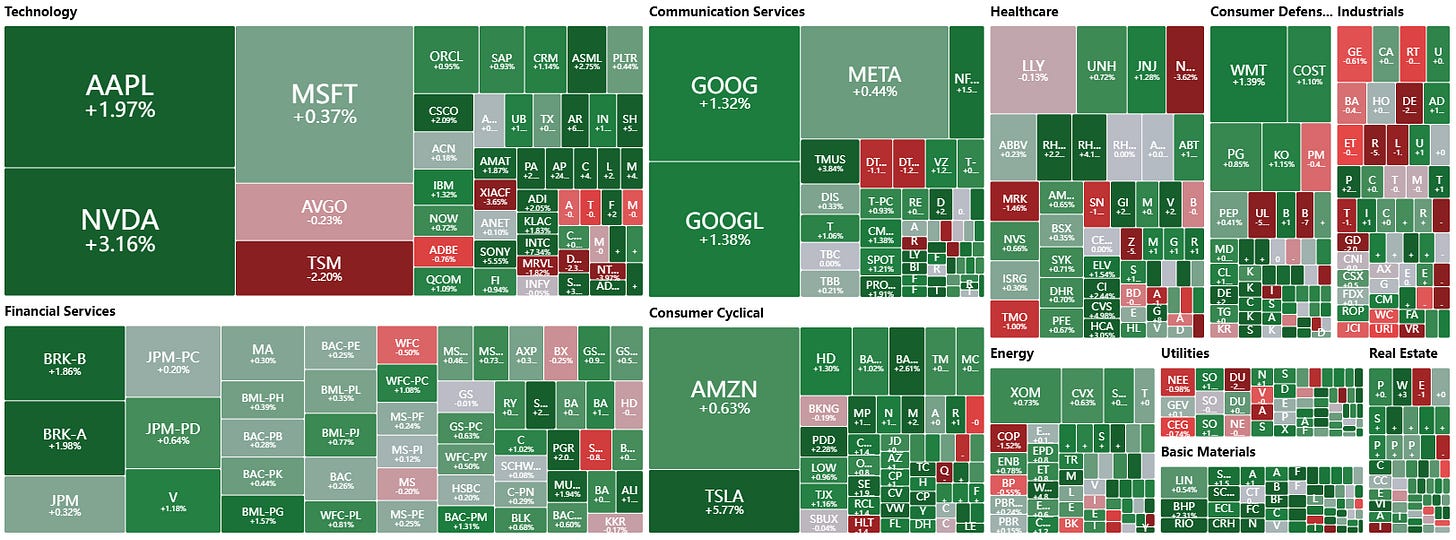

Market Highlights: Tech Sector in Focus

Twilio (TWLO) lost 8% in extended trading due to a weak quarterly report and a disappointing forecast for the next quarter.

Coinbase (COIN) surprised investors with strong quarterly results, surpassing EPS ($4.68) and revenue ($2.27 billion) expectations.

Palo Alto Networks (PANW) declined by 4% despite an increase in ARR Next-Generation Security, as mixed financial results weighed on the stock.

Airbnb (ABNB) showed strong growth, increasing revenue to $2.48 billion (+11.7% YoY), driven by an increase in booked nights.

Intel (INTC) rose over 6% following a decline in Treasury bond yields, which also positively affected ARM (+5%), Micron (+4%), and Nvidia (+2%).

Despite ongoing inflationary risks and mixed macroeconomic indicators, the stock market remains resilient. The decline in prices for some key services and hopes for inflation stabilization support positive investor sentiment. However, markets remain sensitive to upcoming retail sales and industrial production data, which will be released in the coming days. Corporate reports from major companies also remain in focus, as they will help determine the direction of stock indexes in the coming weeks.