Welcome to Our New Section: "Daily Market Review"!

We are excited to introduce a fresh format where we’ll share key events and essential market insights daily.

U.S. Stock Markets Close Tuesday with Significant Gains

The U.S. stock markets ended Tuesday's trading session on a strong note. The S&P 500 (SPX) rose by +0.88%, the Dow Jones Industrial Average (DOWI) gained +1.24%, and the Nasdaq 100 (IUXX) increased by +0.58%. Meanwhile, March E-mini S&P futures (ESH25) advanced by +0.92%, and E-mini Nasdaq futures (NQH25) climbed by +0.78%.

Key Drivers of Growth

Positive Signals from U.S. Policy

The first trading day after President Trump's inauguration saw eased tensions as no immediate tariffs were imposed on China or Europe. However, potential 25% tariffs on imports from Canada and Mexico, planned for February, remain on the table.

Treasury Bond Dynamics

The 10-year Treasury yield fell to a 2.5-week low (4.568%), boosting bond prices. Declining inflation expectations, fueled by a more than 2% drop in WTI crude oil prices, were a significant factor in this movement.

Corporate Earnings

The Q4 earnings season is in full swing. According to Bloomberg, analysts expect S&P 500 companies to report 7.5% year-over-year profit growth—one of the strongest forecasts in three years.

Key Market Highlights

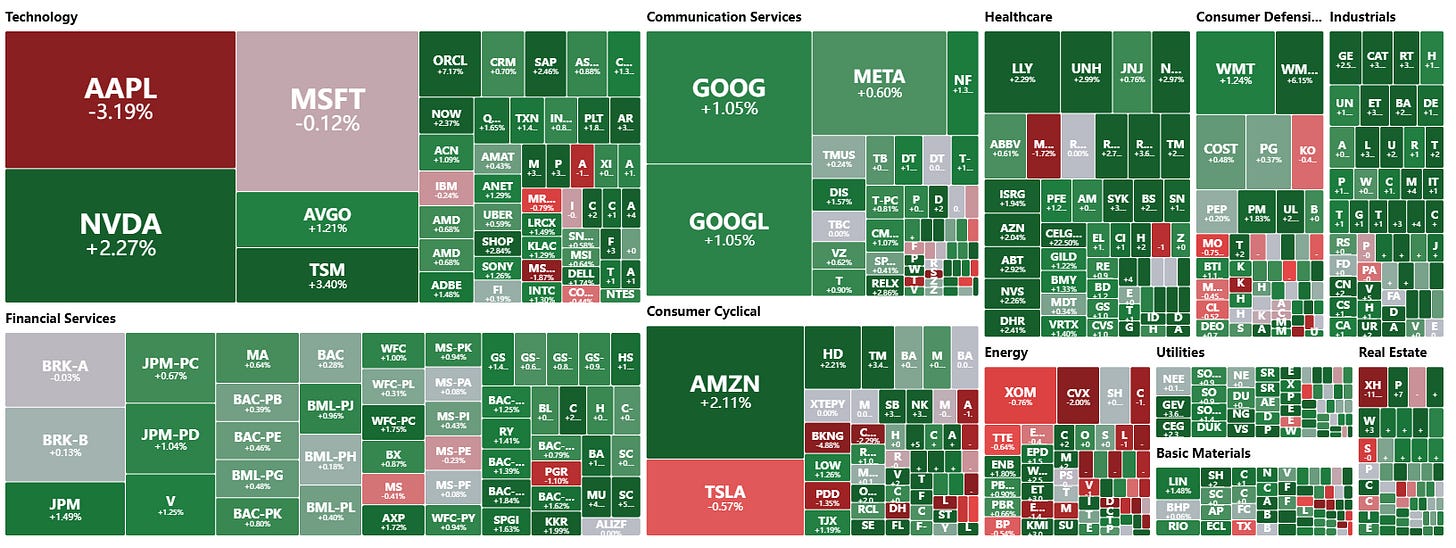

Gainers

Shares of 3M Co (MMM) rose by +4%, fueled by strong quarterly results. Oracle (ORCL) surged +7% following the announcement of a major AI initiative. Micron Technology (MU) and Nvidia (NVDA) gained +3% and +2%, respectively, driven by optimism in the semiconductor sector.

Decliners

Apple (AAPL) dropped -3% due to weak iPhone sales in China and analyst downgrades, while Walgreens Boots Alliance (WBA) fell -9% after a DOJ lawsuit over alleged controlled substance violations.

Energy Sector Under Pressure

Energy giants such as Devon Energy (DVN) and Occidental Petroleum (OXY) declined by more than -2%, as WTI crude oil prices fell to a weekly low of $75.99 per barrel, raising oversupply concerns.

International Markets

European and Asian stock indexes closed mixed. The Euro Stoxx 50 increased by +0.03%, Japan's Nikkei 225 gained +0.32%, while China's Shanghai Composite fell by -0.05%.

Outlook and Forecasts

Interest Rates and Fed Expectations

Markets almost rule out a rate change at the FOMC meeting on January 28–29. Meanwhile, expectations for a European Central Bank (ECB) rate cut next week have reached 99%, with further reductions likely.

European Economic Data

Eurozone new car registrations grew by +5.1% in December, marking the best performance in eight months. However, Germany’s ZEW economic sentiment index declined to 10.3, signaling a less optimistic outlook.

Markets responded positively to favorable news from political developments and corporate earnings. Despite uncertainties such as tariff threats and falling oil prices, investors remain optimistic, as evidenced by the strengthening of key indexes and sectoral successes.