Thursday brought a stark reality check to Wall Street as markets reversed dramatically, wiping out much of the previous day’s gains. The SPX index dropped by 3.46%, the DOWI fell 2.50%, and the tech-heavy IUXX plummeted by 4.19%. E-mini S&P futures (ESM25) fell by 3.51%, and E-mini Nasdaq futures (NQM25) dropped by 4.23%, underscoring intensifying market anxiety.

What Triggered the Decline?

Despite President Trump’s announcement of a 90-day pause on retaliatory tariffs, markets quickly realized that most duties remain intact. Making matters worse, China retaliated with an 84% tariff on U.S. goods, while the U.S. hiked total tariffs on Chinese imports to a stunning 145%.

Other key pressure points included:

Disappointing earnings, with CarMax ( KMX ) plunging 19.5%;

Hawkish Fed comments from Schmid and Logan, emphasizing inflation over rate cuts;

Rising budget deficit concerns following a tax-heavy reconciliation bill;

U.S. dollar slump (-1.9%) reflecting growth concerns;

Deflation signals from China, highlighting weak global demand.

Mixed Signals from U.S. Macroeconomic Data

While inflation and labor market data offered glimmers of hope:

March CPI rose 2.4% YoY—below estimates and the slowest pace in 6 months;

Jobless claims met expectations, with continuing claims falling—suggesting labor market strength.

Still, the market remained fixated on broader structural and geopolitical risks.

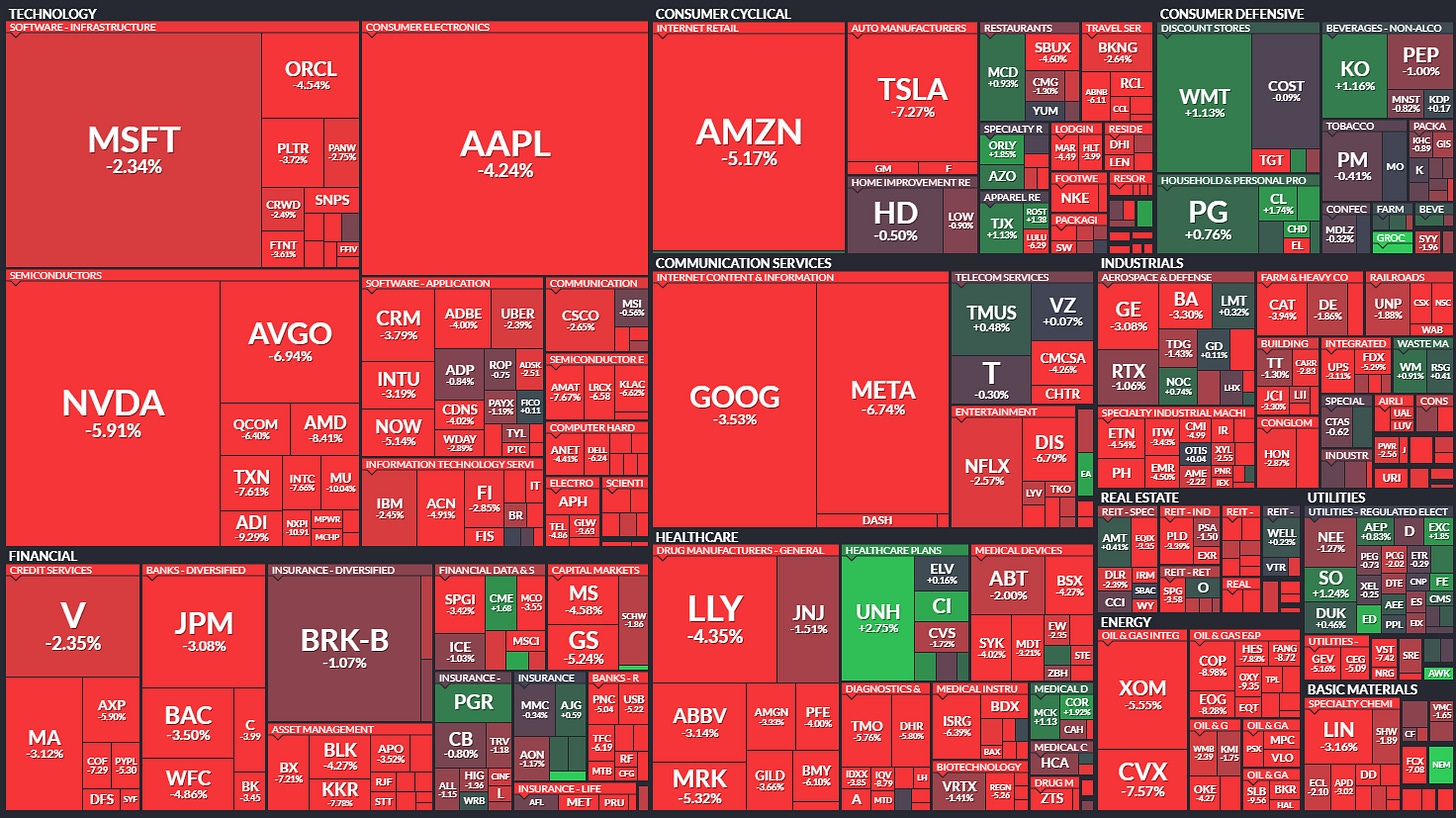

Sector Performance

Only one sector ended in the green—Consumer Staples (+0.2%). The rest saw red:

Energy led the plunge (-6.4%);

Technology and Communication Services fell over 4%;

Semiconductors gave back 8% after gaining 18.7% the day before;

Vanguard Mega-Cap Growth ETF ( MGK ) slid 4.1% after jumping 12.2% a day earlier.

Ziroh Labs unveiled Kompact AI—a CPU-based AI platform that doesn’t require costly GPUs, potentially undermining Nvidia’s (NVDA) stronghold on the AI hardware market. This innovation added to tech sector pressure.

The CBOE Volatility Index (VIX), known as Wall Street’s “fear gauge,” shot above 50—signaling heightened investor anxiety. The rally sparked by tariff relief faded fast, overtaken by renewed concerns about Fed policy, trade wars, and global uncertainty.

Investors will be closely watching:

Friday’s PPI inflation data;

Q1 earnings season kick-off led by major U.S. banks;

Michigan consumer sentiment index;

Geopolitical developments from China, the EU, and the White House.

Markets are entering a turbulent phase. The initial euphoria from tariff relief gave way to the cold reality of entrenched inflation risks, hawkish monetary policy, and intensifying global trade tensions. The week’s volatility reflects not panic, but a repricing of serious long-term risks.