U.S. stock markets turned sharply lower after the close on Wednesday following President Donald Trump’s announcement of his so-called "Liberation Day" tariff policy. The unexpectedly aggressive measures rattled investors and erased earlier gains.

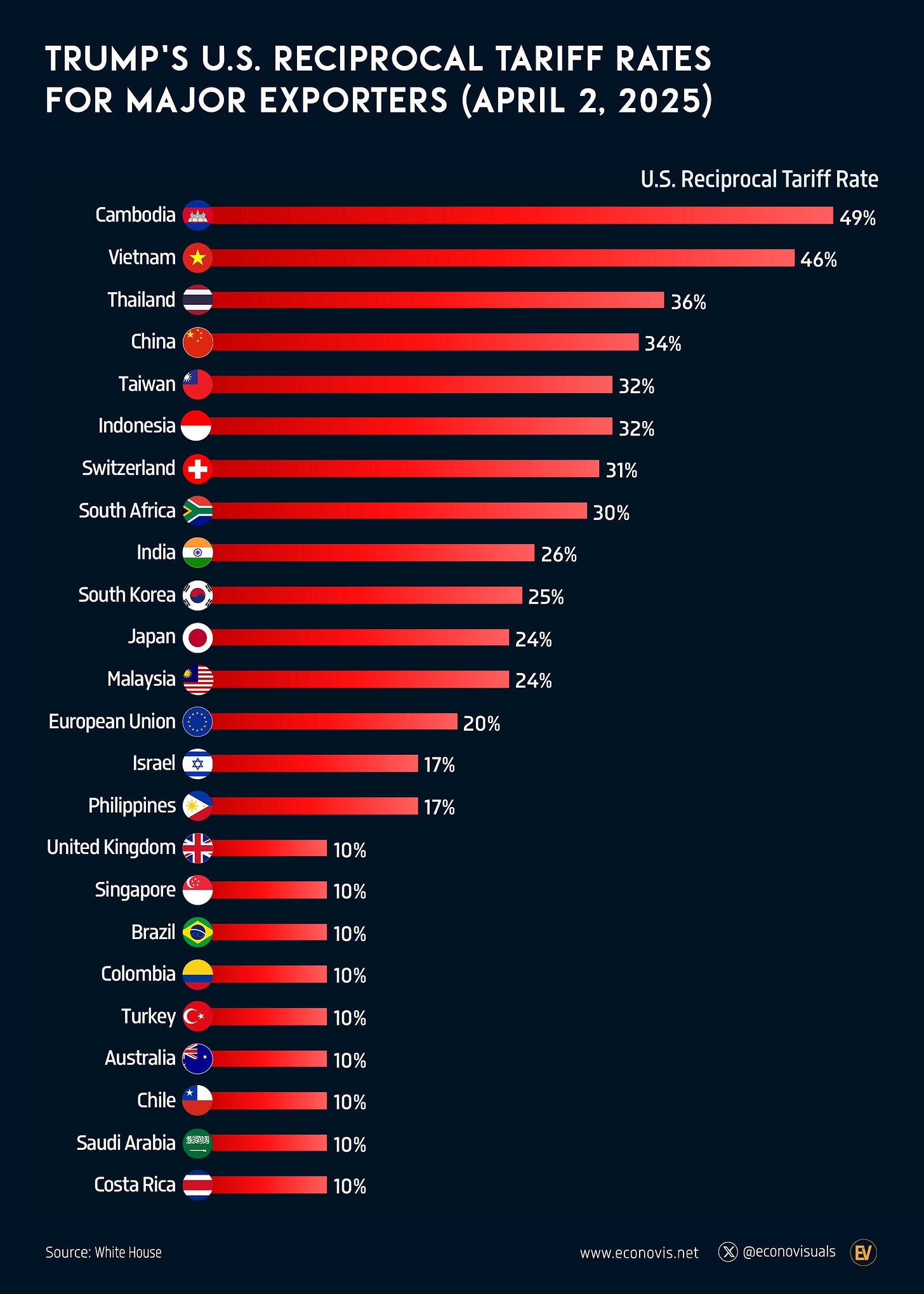

The Invesco QQQ Trust (QQQ), which had closed the regular session up 0.73%, plunged 3.44% in after-hours trading. The SPDR S&P 500 ETF (SPY) dropped 2.45%, wiping out its earlier 0.63% gain. The White House said that base tariffs of 10% would take effect on April 5, with higher rates to follow on April 9. China was hit the hardest, with the total tariff rate on Chinese imports now reaching 54%.

Economy vs. Politics: A Tug of War

Despite geopolitical concerns, the main U.S. indices managed to close higher during regular trading. The S&P 500 rose 0.67%, the Dow Jones gained 0.56%, and the Nasdaq 100 advanced 0.75%. Positive economic news fueled the rally — ADP employment data beat forecasts (155K vs. expected 120K), and factory orders for February rose by 0.6%, exceeding the 0.5% estimate.

Tech giants helped buoy the market. Tesla jumped over 5% after Politico reported Elon Musk would soon leave his role in the Trump administration. Amazon gained 2% following a New York Times report that the company made an offer to acquire TikTok’s U.S. operations.

Bond Yields and Rate Expectations Shift

The yield on the 10-year U.S. Treasury climbed to 4.192%, while bond prices fell, pressured by strong economic data and risk-on sentiment in equities. Markets have now reduced the odds of a 25-basis-point Fed rate cut in May to just 16%.

European bond yields also climbed: the German 10-year bund yield rose to 2.721%, and the U.K.’s 10-year gilt yield ended at 4.640%. ECB Governing Council member Robert Holzmann said he opposes a rate cut at this month’s policy meeting, citing inflation nearing target levels.

Winners and Losers (Thank God that we have winners)

Despite broader market concerns, several stocks stood out. Caesars Entertainment surged 6% after being added to Raymond James’ “Focus List.” GE Vernova gained 5% after a bullish rating from Susquehanna. DoorDash climbed 3% following a partnership announcement with Domino’s. Rocket Cos jumped 9% after Deutsche Bank upgraded the stock to “Buy.”

On the downside, defensive food and beverage stocks fell as the broader market recovered. Hershey, Mondelez, Campbell’s, and others declined significantly. The telecom sector also came under pressure, with Verizon, AT&T, and T-Mobile all losing more than 1%.

The biggest loser of the day was nCino, which plummeted 19% after reporting disappointing earnings and a weak forecast for fiscal 2026.

What's next? (Panic? Sell panic? NO just keep doing your thing.)

Investors will be closely watching the upcoming ISM services index (expected to dip to 53.0) and Friday’s non-farm payrolls report, forecast to show 138,000 new jobs and a steady unemployment rate at 4.1%. Fed Chair Jerome Powell is also set to speak Friday at the Society for Advancing Business Editing and Writing Conference, potentially offering new insights into the Fed’s economic outlook.