Nu Holdings: Latin America’s Financial Giant or a Bubble on the Verge of Bursting?

We analyze NU stock prospects and potential pitfalls for investors.

Nu Holdings Ltd. (Ticker: NU) – One of the Most Exciting Digital Financial Platforms in Latin America

Operating in Brazil, Mexico, and Colombia, Nu Holdings offers convenient digital accounts, credit cards, personal loans, and investment products. And here’s a truly impressive fact: as of the end of Q3 2024, the company had 109.7 million customers. Moreover, Warren Buffett and Berkshire Hathaway have invested in it. But remember, he may invest today and withdraw tomorrow. It’s essential to think for yourself.

Read this first:

Financial report Nu Holdings

Looking at the Numbers from Financial Reports

Revenue: Growing Rapidly

Nu Holdings generated $2.94 billion in revenue in Q3 2024, marking a 56% year-over-year increase. Impressive, right? Especially considering that the majority of income comes from credit card interest, loans, and fees.

Another crucial indicator of business quality is Average Revenue Per Active Customer (ARPAC), which rose 25% to $11. This means the company is not just attracting new users but is also increasing its earnings per customer. This is not just dry statistics—it’s a sign that customers trust Nu and are willing to use its services more frequently.

Profit: Exceeding Expectations

Net profit for the quarter amounted to $553.4 million, compared to $303.0 million a year ago. If we look at adjusted figures, the profit was $592.2 million!

Gross margin is also on the rise—46% compared to 43% last year. This indicates that the company is becoming more efficient. The real question is—how long can this growth rate be sustained?

Cash Flow: A Key Indicator of Stability

Nu is doing well in this area: $1.03 billion in operating cash flow for the first nine months of 2024.

One particularly interesting aspect—the company has $7.65 billion in cash reserves. This is a powerful cushion that can be used for new investments and crisis protection.

Balance Sheet: Finding Balance (Literally)

Nu's total assets stand at $48.64 billion, with a major portion consisting of its $26.24 billion credit portfolio (credit cards and loans).

Deposits are also in good shape—$28.3 billion.

An intriguing point: the loan-to-deposit ratio is 40%, indicating that the company is cautious about issuing loans and doesn’t overload its balance sheet. But are there risks? Absolutely.

Risks: What Could Go Wrong?

Delinquent Loans – Here’s a warning sign: the 90+ day delinquency rate rose to 7.2%. That’s quite significant, and if the trend continues, investors might start to panic. But they can always sell their loan portfolio.

Regulations – Nu operates in multiple countries, meaning it faces different regulatory environments. In Latin America, regulations can change quickly and unexpectedly.

Currency Fluctuations – Nu’s revenue heavily depends on the Brazilian real (BRL), Mexican peso (MXN), and Colombian peso (COP). Think back to 2020 when these currencies fluctuated wildly—that’s a major risk factor.

Technical Perspective on the Stock

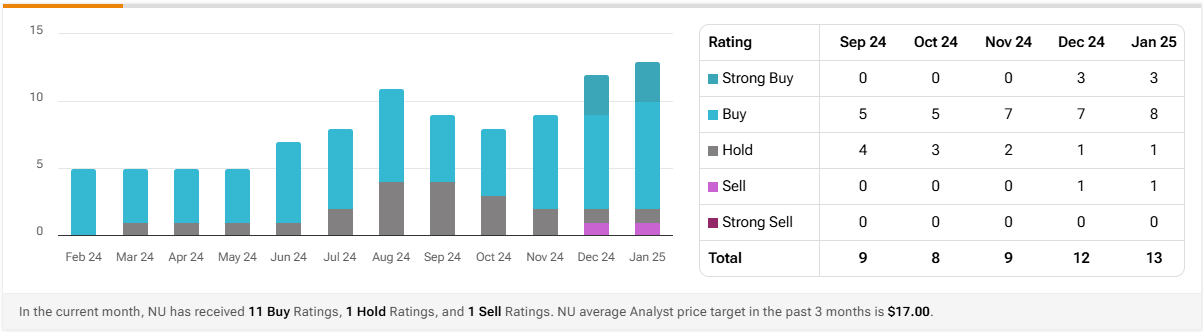

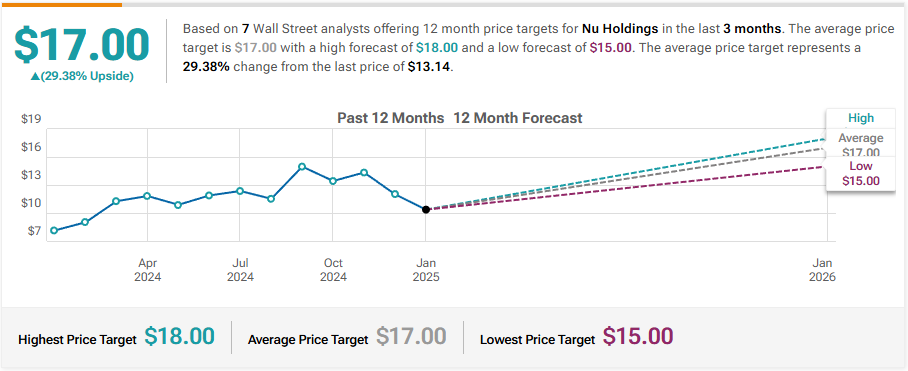

Nu Holdings Ltd.’s stock fell 0.755% on the last trading day (Monday, February 3, 2025), closing at $13.14. Not critical, but a downward trend is forming.

During the day, the stock traded in a 3.29% range—between $12.76 and $13.18. Over the past two weeks, the stock is up 13.96%, but here’s a key detail: trading volume is declining. On the last trading day, volume dropped by 15 million shares—a potentially bearish signal, as volume should ideally follow price trends.

What’s Next?

The stock is currently at the upper boundary of a descending trend channel. This usually signals a selling opportunity, especially for short-term traders.

At the moment, analysts expect the stock to drop by 20.35% over the next three months. With a 90% probability, it will trade within $6.98–$10.61.

However, if the price holds current levels or moves higher, forecasts will shift accordingly.

An Interesting Detail: What Are Insiders Doing?

When insiders—people who know the company best—start actively selling stock, it raises concerns. In the last 100 transactions, insiders sold 1.83 million shares, while buying only 1.41 million. If the management isn’t buying shares, does that mean they don’t believe in future growth?

Growth: Why Is Nu Accelerating?

New Customers – 20.7 million new users over the past year. (but Q4’24 Earnings Results February 20, 2025 – after market close )

Expanding Product Line – For example, PIX financing (Brazil’s instant payment system).

Geographic Expansion – Mexico and Colombia are particularly promising. Why does this matter? If Nu can dominate these markets like it did Brazil, its market cap could skyrocket.

Should You Buy?

Nu Holdings is a unique player in the banking industry. It has grown to 109 million customers not by chance—people love its convenience, lack of hidden fees, and transparent approach.

But are there hidden risks? Absolutely. Rising loan delinquencies are concerning, and if they worsen, the stock could drop. On the other hand, the company holds $7.65 billion in cash, and the business continues to grow.

Short-term indicators suggest a buy, but the long-term trend remains downward, and much depends on upcoming support levels. Looking ahead over a year, Nu stock could be an interesting opportunity—on one side, strong growth, on the other, a reasonable valuation.

Risk? Yes. Potential? Also yes.