Pfizer: Between Past Successes and an Uncertain Future

Can the pharmaceutical leader maintain its position amidst new challenges?

Pfizer Inc. is not just a name everyone knows; it’s a company with roots dating back to 1849. Heard of the Comirnaty vaccine or the Paxlovid treatment? Of course, you have. These products have catapulted Pfizer into the spotlight in recent years. What’s interesting is that the company doesn’t limit itself to the U.S. — it serves everyone from wholesalers to government agencies worldwide.

Read this first

Financial reports Pfizer

Balance Sheet

Assets: As of the end of September 2024, total assets stood at $219.5 billion. That’s down from $226.5 billion in December of last year. The main drop? Long-term investments (from $3.7 billion to $2.2 billion) and cash (from $2.9 billion to $1.1 billion). To me, this signals significant spending on the Seagen integration and covering current liabilities. But, honestly, the inventory increase from $10.2 billion to $11.7 billion raises questions: is this preparation for increased demand or just a hedge against supply chain disruptions?

Liabilities: On a positive note, short-term liabilities dropped from $47.8 billion to $43.2 billion. Clearly, the company paid off some debts and trade obligations. Meanwhile, long-term debt fell to $58.0 billion. Is Pfizer trying to shield itself from high debt levels?

Equity: Here’s where it gets more interesting. Net equity grew to $92.3 billion, mainly driven by retained earnings ($121.1 billion). This suggests that profits are covering not only dividends but also leaving room for growth.

Cash Flow

Operating Activities: Net operating cash flow was $6.0 billion. That’s significantly higher than $3.5 billion a year earlier. Why? The company’s better cash management and improved operational profitability. Isn’t that what every business aims for?

Investing Activities: Here’s an intriguing point: a positive cash flow of $4.3 billion, thanks to the sale of its Haleon stake ($3.5 billion). Though, the reduction in long-term investments does make one wonder about future growth. Is it worth the trade-off?

Financing Activities: Outflows of $12.0 billion reflect dividend payments ($7.1 billion) and debt repayments ($2.3 billion). Something tells me this is a strategic move to maintain shareholder confidence while reducing debt.

Share Capital

Insiders are neutral: slightly more shares were purchased than sold (2.06 million vs. 2.05 million). The latest transaction? James Smith bought 1.7 thousand shares. Funny, isn’t it? Even such small purchases can fuel interest in the company’s growth potential.

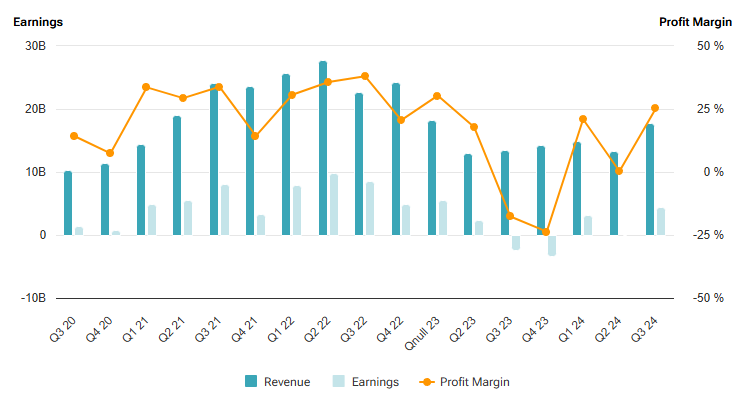

Income Statement

Revenue: Pfizer impresses here. Revenue grew 31% in Q3 2024, reaching $17.7 billion. The main driver? Product revenue, which rose by $3.8 billion.

Costs: The reduction in cost of goods sold to $11.9 billion is, in my opinion, the key highlight. Lower COVID-product expenses mean higher profitability. Interestingly, R&D expenses remained steady at $7.8 billion. Why cut back on investments in the future, right?

Profit: Net income increased to $7.6 billion. That’s a solid argument for the company’s resilience. With a net margin of 16.6%, Pfizer is becoming more efficient.

Overall

Pfizer continues to surprise: steady revenue growth, reduced debt, and ongoing investments in innovation. But I can’t ignore the risks: declining demand for COVID products and dependence on the U.S. market — it’s like sitting on a powder keg. Will Pfizer overcome these challenges? I think time will tell. What do you think? Should we trust this pharmaceutical giant, or is it better to look for new opportunities? That’s a million-dollar question.

Current Metrics

Current Price: $26.89

P/E Ratio: 35.85 (high relative to peers, indicating overvaluation)

52-Week High: $31.06

52-Week Low: $24.11

Forward EPS: $2.93

PEG Ratio: 0.12 (indicating strong growth potential relative to valuation)

Short-Term Investment Strategy

Entry Point: Look for pullbacks near $26.50 (support level) for a better margin of safety.

Exit Point: Consider selling near $27.50-$28.00, as resistance levels indicate limited upside in the short term.

Risk: Short-term risks include market volatility and declining COVID-related revenue streams.

Long-Term Investment Strategy

Buy Signal: Pfizers low PEG ratio (0.12) indicates strong long-term growth potential, particularly in its pipeline of oncology and mRNA-based therapies.

Time Horizon: A 3-5 year investment horizon is recommended to capitalize on pipeline developments and recovery from post-COVID revenue declines.

Dividend Stability: Pfizer offers a reliable dividend, appealing to income-focused investors, though yields may fluctuate based on earnings.

Risk Assessment

COVID-19 Revenue Decline: Sales from Comirnaty and Paxlovid are shrinking, creating revenue headwinds.

Valuation Risk: A P/E ratio of 35.85 suggests the stock is expensive compared to peers in the pharmaceutical sector.

Pipeline Dependency: Success in its drug pipeline is critical to justify current valuations and drive future growth.

Investment Thesis

Pfizer is a mature pharmaceutical company with strong cash flow and a robust drug pipeline. However, its reliance on COVID-related products has created near-term revenue challenges. Long-term growth hinges on its ability to commercialize new drugs and vaccines effectively. While the PEG ratio highlights growth potential, the high P/E ratio suggests caution. Short-term traders may find limited upside, while long-term investors with patience and a focus on dividends could see meaningful returns.