Robinhood: From Crypto Booms to Billion-Dollar Profits

How one of Wall Street's most talked-about companies turns risks into opportunities and builds the future of investing.

Robinhood Markets , Inc. (Ticker: HOOD) is a U.S.-based financial services platform that revolutionized retail investing by offering commission-free trading. Its user-friendly platform allows trading in stocks, ETFs, options, gold, and cryptocurrencies. With a focus on accessibility and innovation, Robinhood attracts a younger demographic but faces criticism for monetizing order flow and encouraging risky trading behavior.

Please read this first:

Financial reports Robinhood Markets

Balance Sheet

Looking at Robinhood's balance sheet, the first thing that stands out is the 33% growth in assets, from $32.332 billion to $43.245 billion over nine months. Impressive, right? But let’s break down where this growth is coming from. The main driver? Crypto-related assets. They surged to $19.456 billion, almost half of the total assets. That’s great, but it raises questions: what if the crypto market takes another nosedive?

Additionally, user assets (fractional shares) increased to $2.201 billion. That’s another positive sign—people are actively investing. However, the company’s liabilities grew even faster than its assets, rising 41% to $36.037 billion. The main growth came from user crypto liabilities and securities lending, which doubled to $7.306 billion. This might be normal for a fast-growing company, but high debt levels are not ideal in such volatile times.

Still, shareholder equity has risen—from $6.696 billion to $7.208 billion. The reduction in accumulated losses from $5.446 billion to $4.951 billion shows that the company is on the right track. But is that enough? Or does it need more?

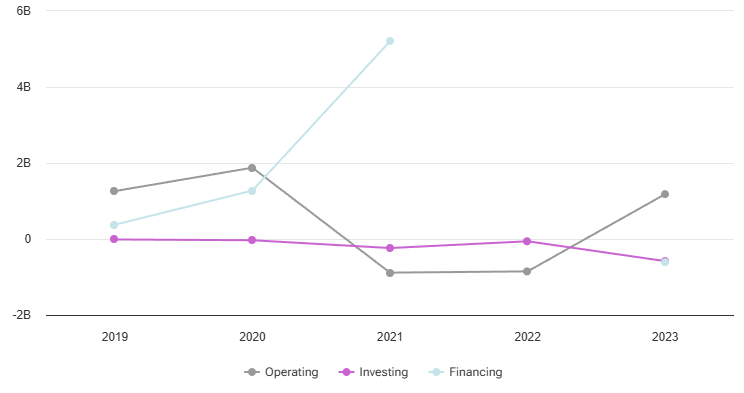

Cash Flow

Operating activities generated $1.243 billion—five times more than the $221 million reported last year. That’s phenomenal. But why? The growth in revenue and better working capital management are to thank. One can only imagine how many late nights Robinhood’s financial analysts spent to achieve these results.

Investing activities tell a different story. There was a net outflow of $182 million, with the bulk spent on acquiring long-term assets and software development. That’s good if the investments pay off, but for now, it looks like a long-term play.

As for financing activities, there was a $167 million outflow, with most of it used for share buybacks. An interesting move, but does it help increase share value? Not immediately clear.

Share Capital

Class A shares increased from 745.4 million to 762.0 million, while Class B shares decreased from 126.8 million to 121.6 million. At first glance, this seems like typical dynamics. But let’s dig deeper. The company bought back $97 million in shares and issued $245 million in shares to employees as part of compensation programs. While this is standard practice, it raises questions: how motivating are these programs, and do they dilute shareholder equity?

The $495 million reduction in accumulated losses, thanks to net income, is great news. But frankly, given the past losses, it’s not enough yet to change market perception entirely.

Income Statement

Robinhood’s revenues grew 39% to $1.937 billion. Impressive, isn’t it? The main driver was transaction-based revenue, which jumped 66% to $975 million—a direct reflection of user activity on the platform. However, net interest income grew by just 17%. Is that too slow?

What’s really encouraging is the 27% reduction in total operating expenses—from $1.956 billion last year to $1.439 billion now. Notably, the “General and Administrative” line item was slashed by more than half. Is this not a sign of sound management?

The company also achieved net income for the first time in a long while—$495 million versus a $571 million loss last year. But the question remains: is this a long-term trend or just a fortunate set of circumstances?

Overall

Robinhood has undoubtedly made huge strides forward. Revenue growth, cost optimization, and reduced losses are all commendable. However, risks remain. The high share of crypto assets is like keeping all your eggs in one basket. If the crypto market crashes, all this growth could turn to dust.

Moreover, the company’s business heavily relies on transaction-based revenue. What if the market slows down, or regulators start creating roadblocks again? Yes, the company is taking steps toward diversification, like developing its credit business, but this is only the beginning.

So the big question remains: can Robinhood maintain this momentum if the winds change? Or is this a temporary improvement that will soon fade? Time will tell, but for now, it seems the company has found its path to a brighter future.

Current Metrics (As of 2025-01-08)

Current Price: $40.56

P/E Ratio: 69.93 (elevated, reflecting growth expectations)

52-Week Range: $10.38 - $43.83

Growth Rate: 25.86% (impressive but priced in)

PEG Ratio: 2.7 (overvalued relative to growth)

Short-Term Investment Strategy

Given its recent price of $40.56, Robinhood appears to be nearing resistance levels ($43.12). Short-term traders should approach cautiously:

Suggested Entry: Look for a pullback to $37.00$38.00 for a safer entry point.

Target Exit: Around $43.00, aligning with resistance levels.

Stop-Loss: Set at $34.00 to manage downside risk.

Risk: Volatility is high due to speculative trading activity. A failure to break resistance could lead to a sharp decline.

Long-Term Investment Strategy

Robinhood has made strides in diversifying its revenue streams (e.g., crypto trading, credit cards). However, its elevated valuation (P/E of 69.93) suggests limited margin for error. Long-term investors should consider:

Suggested Entry: Below $35.00 to ensure a margin of safety.

Target Exit: $50.00+ if the company sustains 25%+ growth and improves profitability.

Risk Factors: Regulatory scrutiny, reliance on payment for order flow, and potential decline in retail trading activity.

Key Risk: A downturn in retail investor enthusiasm could severely impact Robinhood's growth trajectory.

Investment Thesis

Robinhood is a growth story with strong brand recognition and a unique position in the retail trading market. However, its current valuation leaves little room for error:

Strengths: Strong user growth, innovative product offerings (e.g., crypto trading, credit cards).

Weaknesses: Heavy reliance on volatile revenue streams like cryptocurrency and payment for order flow.

Valuation Concerns: A P/E ratio of 69.93 and PEG ratio of 2.7 suggest the stock is overvalued relative to its growth.

Regulatory Risk: Potential changes in SEC regulations could disrupt its business model.

Robinhood's elevated valuation demands perfection in execution. Short-term traders may find opportunities in its volatility, but long-term investors should wait for a more attractive entry point to mitigate risk. Focus on fundamentals, and don't let hype cloud your judgment.