Semrush: Digital Spy or a Marketer’s Ultimate Tool?

How a SaaS platform helps businesses survive.

Semrush Holdings, Inc. (NYSE: SEMR) is a company that literally helps businesses "survive" in the digital world. It’s not just a service but a full-fledged toolkit. The company provides a SaaS platform for marketers, entrepreneurs, and large corporations that want to know everything about their competitors, keywords, and trends.

Read this first:

Financial report Semrush Holdings, Inc.

Their headquarters is in Boston, but they operate far beyond the U.S.—covering Europe, Asia, and Canada. It seems like this has become a critically important service in today’s world, doesn’t it?

Numbers Don’t Lie. Or At Least, They Shouldn’t.

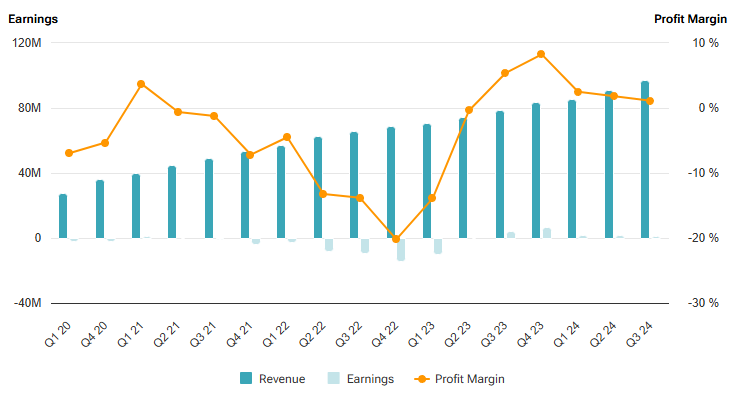

Revenue

For the first three quarters of 2024, revenue amounted to $274.2 million, which represents a 22% rise from the same period in 2023 ($224.3 million). The figures are increasing, but how sustainable is this increase? When a company boosts its revenue but does not manage expenses effectively, this could lead to issues. However, so far, Semrush has shown healthy dynamics, which is a positive sign for investors.

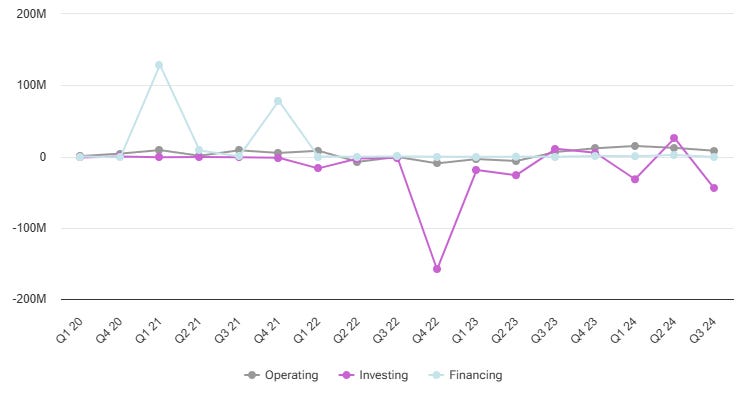

Cash Flows

Operating activities generated $35.1 million.

Investing activities resulted in a negative cash flow of $51 million, primarily due to software purchases and development costs.

Cash reserves: $45 million in cash and $187.8 million in short-term investments.

A key observation: the company reinvests the money it earns into development. This is great for future growth, but what if the SaaS market starts stagnating? That’s a major risk.

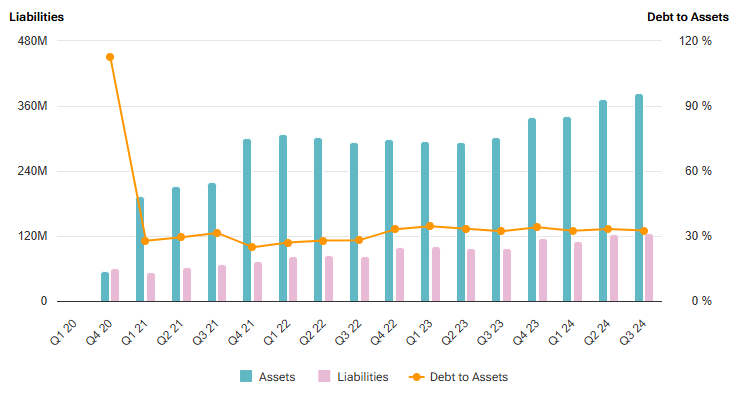

Balance Sheet

Assets: $383.8 million, mainly consisting of cash and short-term investments.

Liabilities: $124.8 million, of which $68.9 million are deferred revenues (subscriptions already paid but services yet to be provided).

Equity: $259 million. The financial cushion looks solid, which is reassuring.

Profitability

Gross profit: $227.5 million (82.9% margin). That’s an impressive figure—one of the best margins in the SaaS industry.

Operating profit: $6.57 million. Modest, but positive. This indicates improved cost control.

Net profit: $4.1 million for the first nine months. The company is moving toward sustainable profitability, but is the growth pace fast enough?

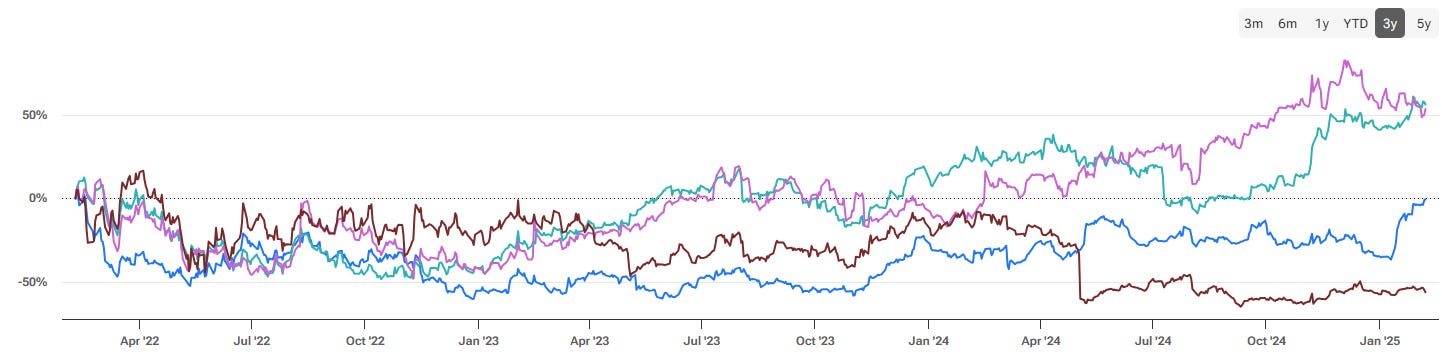

Stock Performance

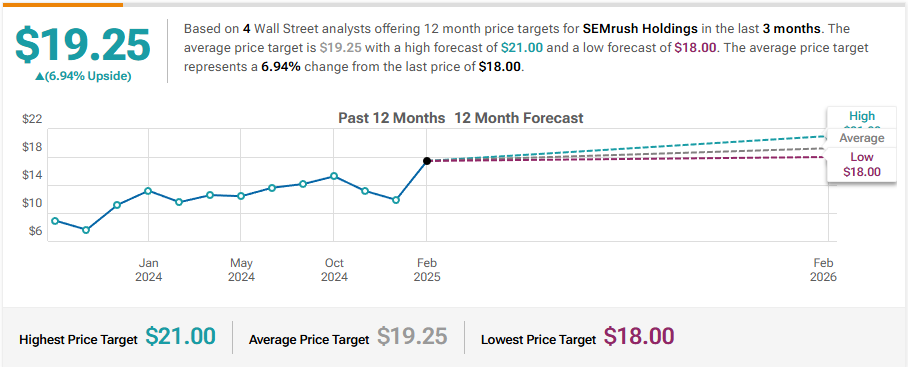

P/E ratio: 223.12 – an insanely high valuation! Is this the Tesla of the SEO world?

52-week high: $18.24

52-week low: $9.64

Dividends: None (but who was expecting them from a high-growth tech company?).

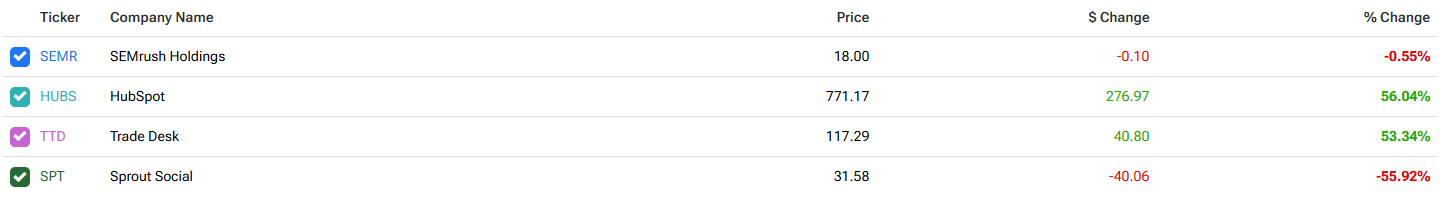

Compare Stocks

Risks and Challenges

Now, some harsh realities. Yes, Semrush is growing, but a P/E ratio of 223 is a red flag. To justify this valuation, the business needs explosive growth. But is that happening?

-Profitability is still fragile. Excluding non-GAAP adjustments, margins aren’t impressive. Strategic missteps could be costly.

-Brutal competition. Google Analytics, Ahrefs, Moz—all have strong advantages, and many offer free tools. Semrush must constantly prove its value.

-What if the market slows down? Small and mid-sized businesses are Semrush’s main clients. If they start cutting costs, who gets hit first?

Can the company maintain its momentum despite fierce competition?

Insiders seem bearish, selling more shares than they buy.

Over the last 100 transactions, 4.79 million shares were bought while 14.47 million were sold.

The latest sale happened four days ago, when Eugene Levin sold 15.09K shares.

Although it can be linked to various causes, this usually indicates something harmful.

Growth Areas

New offerings: Semrush is introducing features designed for enterprise clients, providing analytics that are becoming more precise.

Mergers & Acquisitions: In 2024, they acquired Exploding Topics and Ryte GmbH, strengthening their dominance in the niche.

International growth: They are taking proactive steps to expand their presence in Europe and Asia, targeting all sites where businesses seek digital marketing.

Is It a Good Investment?

With a revenue increase of 24% in Q3 2024, Semrush has already garnered over 82,000 paying customers. The company is incorporating AI, and if they can successfully monetize these tools, it could lead to a significant breakthrough for them.

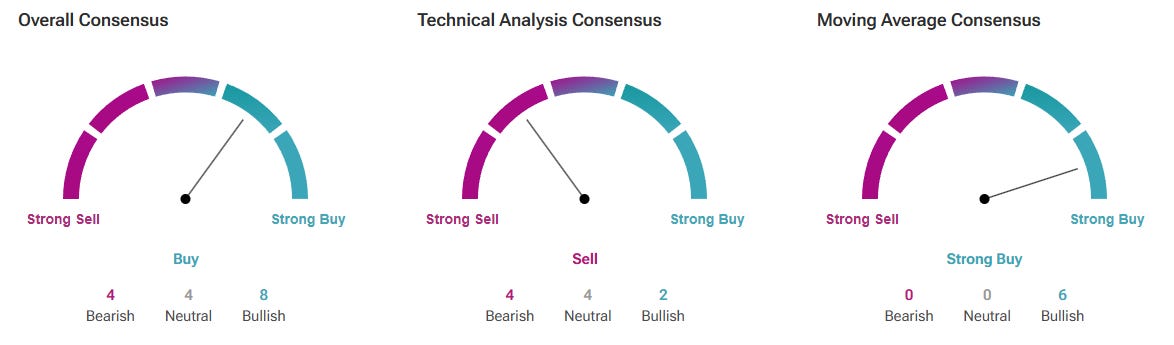

But right now? The stock is overheated. From a technical analysis perspective, it makes more sense to wait for a pullback.

Short-Term Strategy

Wait for a drop to $15.50–$16.00 for a logical entry point.

Target profit-taking at $18.00–$18.50 (near the yearly high).

Stop-loss at $14.50 in case things go south.

Long-Term Strategy

If Semrush continues growing at 20%+ annually, its stock could look very different in 3–5 years. But three key factors need monitoring:

1. AI monetization: If they succeed, this could be a game-changer.

2. Competitive landscape: New entrants or unexpected innovations could shift the market.

3. Profitability trends: If they stay in a low-margin zone, investors might lose interest.

My verdict

Semrush is a company with great potential, but in my opinion, it currently looks overvalued. This doesn’t mean the stock is bad, but it’s not suitable for a spontaneous purchase. Yes, the chart suggests it has the potential to rise to $30. However, it makes sense to wait for a more reasonable price.

Semrush appears to be a promising option if you appreciate companies that are actively expanding and open to risk. However, if reliability is what you seek, it may be worthwhile to think about SaaS companies that are more established.