Sharp Decline in U.S. Stock Markets: What’s Happening and What to Expect Next

Market news 17 apr

U.S. stock indexes closed with significant losses amid escalating geopolitical tensions, worsening economic forecasts, and growing uncertainty around the Federal Reserve’s monetary policy. The S&P 500 dropped by 2.2%, the Nasdaq Composite fell by 3.1%, and the Dow Jones slid by 1.7%—marking one of the sharpest declines of the year.

Market Pressure: Tech Sector at the Epicenter

The tech sector, particularly semiconductor stocks, played a central role in dragging the market down. Nvidia tumbled more than 6% after the U.S. government banned sales of its H20 chips to China, with the company estimating a $5.5 billion impact in Q1 alone. Additionally, ASML plunged over 7% after reporting lower-than-expected orders for the quarter.

Other major chipmakers followed suit: AMD (-7%), GlobalFoundries, KLA, Applied Materials, Lam Research, Intel, Broadcom, and Texas Instruments all closed deep in the red.

Powell’s Remarks and the Tariff Storm

Further pressure came from Federal Reserve Chair Jerome Powell, who warned that increasing trade tensions could stoke inflation and slow growth. He made it clear that the Fed is in no rush to cut interest rates, preferring to wait for more clarity on the economic outlook.

Meanwhile, the U.S. trade policy continues to intensify, with new tariffs introduced on imports from China, Mexico, and Canada, as well as foreign-made automobiles. China and other countries have responded in kind, fueling investor concerns over the future of global trade.

Economic Data: Strong but Not Enough

Despite the market rout, U.S. macroeconomic data came in relatively strong:

Retail sales rose by 1.4% in March, matching expectations.

Manufacturing output climbed by 0.3%, beating forecasts.

NAHB Housing Market Index surprisingly rose, signaling some rebound in the housing sector.

Still, positive economic figures failed to offset the broader anxiety stemming from policy uncertainty and global trade disruptions.

Corporate Earnings: Mixed Signals

The Q1 earnings season kicked off with a mix of disappointments and surprises:

Interactive Brokers missed revenue expectations—its shares sank 9%.

JB Hunt, Omnicom, and AGCO also reported weak results, triggering 5–7% drops in share prices.

However, several companies posted stronger-than-expected earnings:

Abbott Laboratories, Travelers, Autoliv, Newmont, and Lockheed Martin all saw share price increases after beating estimates or receiving analyst upgrades.

Global Markets: Mixed Performance

Global equity markets showed a mixed performance. China’s market rose on hopes of stabilization in U.S.–China relations, while Japan and Europe ended the day in negative territory. Meanwhile, U.K. inflation data came in lower than expected, increasing the likelihood of a rate cut from the ECB at its next policy meeting.

Bond Market: Flight to Safety

As equities plunged, investors moved into safe havens like U.S. Treasuries. The yield on 10-year bonds dropped 7 basis points to 4.263%, with a strong bid at the $13 billion 20-year Treasury auction. The bond market also received support from falling inflation in Europe.

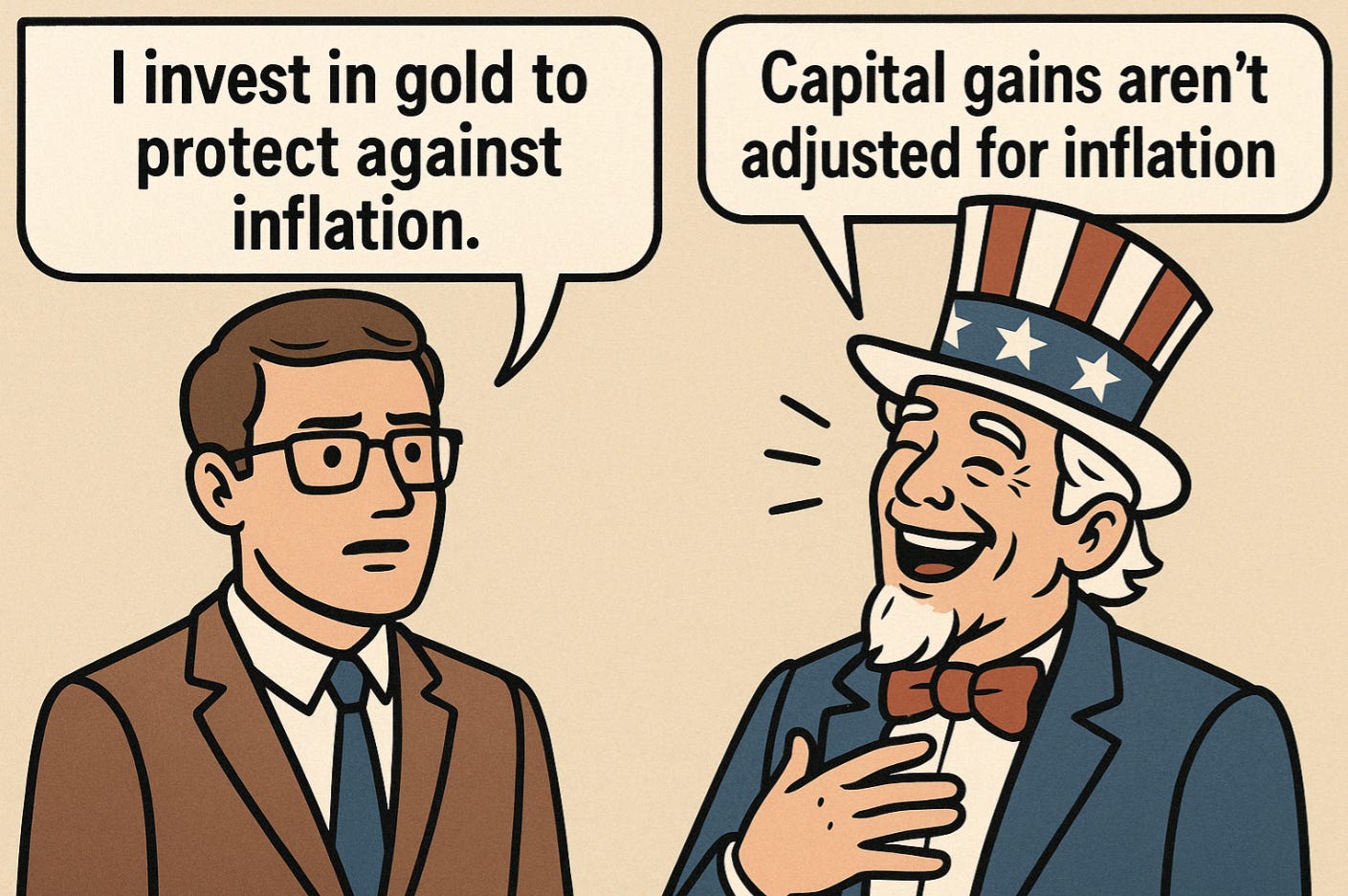

The next few weeks, including more earnings reports and job market data, will be crucial for determining short-term market direction. For now, sentiment remains cautious, with capital shifting toward safe assets like Treasuries and gold.