SoFi Technologies: An Overvalued Star of Fintech?

High Expectations or a Perfect Shorting Opportunity

The financial industry is rapidly changing, and businesses who offer simply accessible digital solutions are at the forefront of this transformation. SoFi Technologies, Inc. (NASDAQ: SOFI) is one such company. SoFi started as a platform for refinancing student loans and has now grown into a whole financial ecosystem.

Today, it provides a wide range of services, such as lending, investing, digital banking, and technical infrastructure for other fintech companies.

Read this first:

Financial report Sofi Technologies Inc

What sets SoFi apart?

SoFi successfully integrates traditional banking services and cutting-edge technology. Recent acquisitions, including Galileo and Technisys, have enabled the corporation to go beyond normal services and provide infrastructure to other financial institutions. This strategy not only increases SoFi's position within the fintech ecosystem, but it also generates additional revenue streams.

Notably, the platform's user base is growing. By the end of 2024, the number of users had surpassed 9.37 million, demonstrating the high demand for digital financial products.

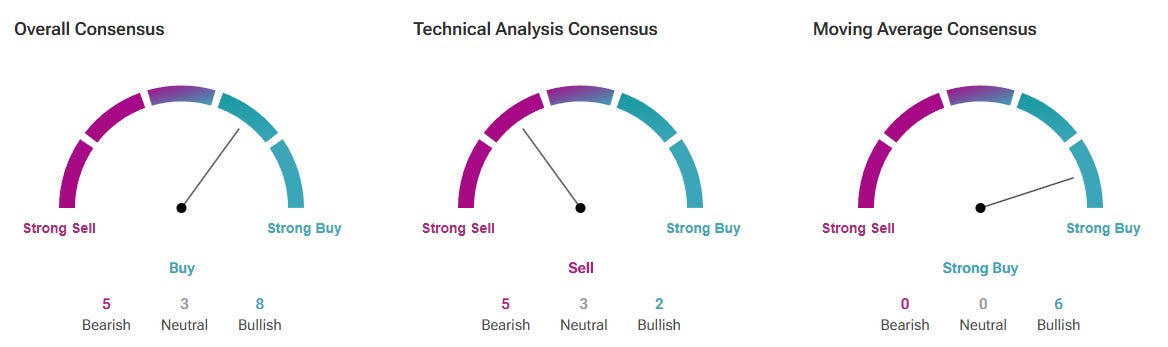

What Are the Results of Investment Metrics?

The following are important stock parameters:

Price-to-Earnings Ratio (P/E): 146.58; current price: $17.59. Investor optimism for the company's future is reflected in this high ratio.

Growth Rate of EPS: 141.67%. Even for rapidly expanding fintech organizations, such growth rates are uncommon.

The ratio of price to earnings to growth, or PEG, is 1.03. This number suggests that the stock has a fair market value.

SoFi is a reasonably balanced option because, for example, stocks of businesses with comparable growth rates frequently have a PEG above 1.5.

Which Approach to Choose: Short-Term or Long-Term Strategy?

For Traders:

Short-term investors may consider buying shares in the $16.50–$17.00 range. This level is close to the support level ($16.30). Target exit levels are in the $18.00–$18.50 range, aligning with the annual high.

However, volatility should be taken into account, especially with the company’s financial report scheduled for January 27. Caution is advised, as the high valuation makes the stock sensitive to unexpected market changes, whether macroeconomic factors or financial performance.

For Long-Term Investors:

If you plan to hold the stock for 3–5 years, pullbacks to $15.50–$16.00 can be used to increase positions. SoFi is actively building its user base, which improves its market position in the digital banking space.

Short Interest

SoFi Techs's (NYSE:SOFI) short percent of float has fallen 4.93% since its last report. The company recently reported that it has 129.10 million shares sold short, which is 12.53% of all regular shares that are available for trading. Based on its trading volume, it would take traders 3.1 days to cover their short positions on average.

According to Benzinga Pro, SoFi Techs's peer group average for short interest as a percentage of float is 6.32%, which means the company has more short interest than most of its peers.

2024 Financial Results: Highlights and Takeaways

Revenue

SoFi recorded total revenue of $1.94 billion for the first nine months of 2024, a 29% increase from $1.51 billion during the same period in 2023. The company’s main revenue sources are lending, technology platforms, and financial services. This growth highlights its strengthening position in key business segments.

Profitability

The company achieved a net profit of $166 million for the first nine months of 2024, a significant improvement from a net loss of $349 million in the same period last year. Earnings per share (EPS) likewise show this improvement, coming in at $0.14 basic and $0.08 diluted. Such advancements show that SoFi is successfully advancing its goal of increasing operational effectiveness.

Cash Flows

Operating Activities: Net cash outflow of $919.7 million, an improvement compared to the same period last year.

Investment Activities: Loan and securities investments accounted for the majority of the $3.54 billion net outflow.

Financing Activities: Debt issuance and deposit growth drove a $3.81 billion net inflow.

These figures demonstrate how SoFi strikes a balance between capital raising and growth investment.

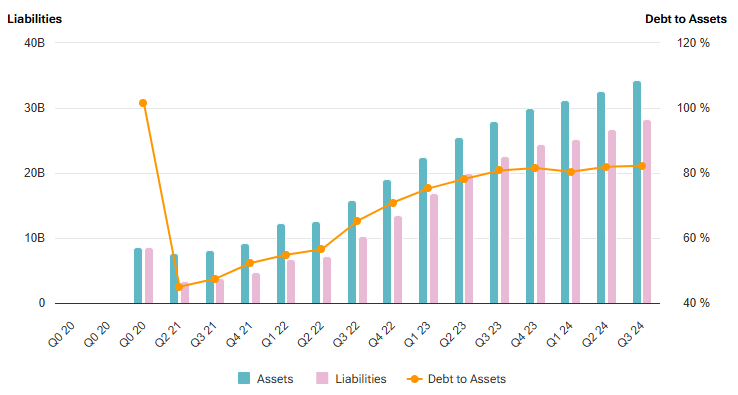

The balance sheet

Total assets increased from $30.07 billion at the end of 2023 to $34.38 billion as of September 30, 2024. The expansion of the loan portfolio and deposits was a major factor in this rise. Deposits increased 31% to $24.4 billion, while liabilities increased to $28.26 billion. These numbers show consistent client confidence and effective scaling initiatives.

However, because of large investments in securities and loans, cash flows from investing activities continue to be negative.

What Risks Should Not Be Ignored?

Despite positive trends, certain risks remain:

Rising interest rates could reduce loan origination volumes and increase the cost of capital.

The portfolio's large percentage of personal loans (62%) makes it more susceptible to changes in the economy.

Reliance on outside funding and large financial outflows for investments present possible difficulties.

Insider Perception:

Insiders sell more shares than they purchase, reflecting their generally pessimistic perspective. 10.33 million shares were bought and 35.07 million were sold within the last 100 transactions. Steven J. Freiberg purchased 7,570 shares 247 days ago, which was the most recent transaction. In general, insider sales exceeding purchases may be interpreted as a warning indicator.

These factors must be considered while assessing the company's future.

In conclusion

Financial results for SoFi have significantly improved, demonstrating the company's capacity to expand even under difficult market conditions. The business successfully diversifies its sources of income and keeps enhancing its position in the market.

Investments should be made cautiously, nevertheless, given the dangers connected to shifting economic situations. Maybe short? Or not.