Tractors That Feed the World.

CNH Industrial: Leaders in Agricultural and Construction Innovations. Invest in Sustainable Growth Today!

Who really controls the globe, do you know? excavators and tractors. And it's no laughing matter. It is owned by CNH Industrial NV (NYSE: CNH). They produce the machinery that physically feeds us and aids in the construction of bridges, roads, and other infrastructure.

Read this first:

Financial report CNH Industrial NV

Brands like Case IH and New Holland Agriculture are well-known, with their machinery operating on fields and construction sites worldwide, from North America to Asia. Moreover, CNH doesn't just sell machinery; they also offer convenient financial solutions to make their equipment more accessible.

Let’s talk about the numbers.

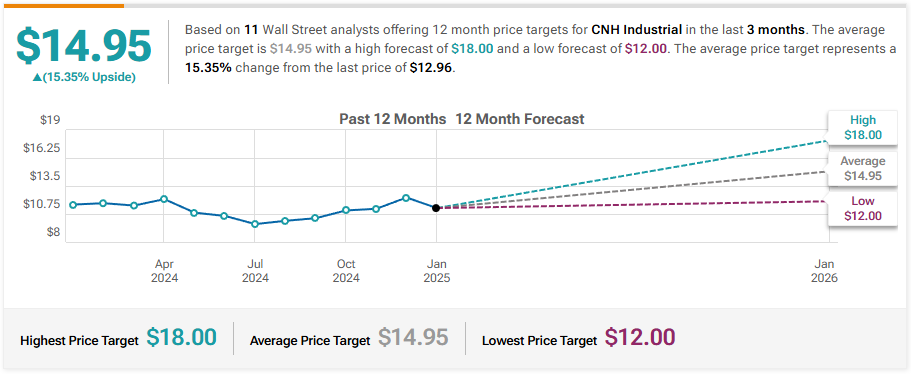

The current stock price is $12.96. At first glance, it seems affordable, especially with a P/E ratio of 9.53. However, it’s worth considering why the ratio is so low. Growth rate? Negative: -13.97%. That’s a signal that not everything is smooth. The 52-week high is $13.15, while the low is $9.28. This is an intriguing fact. I believe that waiting for a pullback is worthwhile.

Revenue

Compared to $17.9 billion for the same time in 2023, CNH Industrial reported $14.96 billion in revenue for the nine months ending September 30, 2024.Reduced sales in the construction and agricultural equipment divisions are the cause of the decline, suggesting shifts in consumer preferences or short-term difficulties in these markets.

Cash Flows

Compared to the negative $608 million reported a year before, operating cash flow was up to $276 million. Better working capital management is seen in this improvement. However, because of large investments in retail finance, free cash flow is still negative.

Balance Sheet

The overall assets of the corporation are $44 billion, including $1.8 billion in cash and equivalents. There are $27.3 billion in debt and $36.3 billion in liabilities. The debt-to-equity ratio of 3.54 indicates a high level of debt but also the need for caution in a volatile market.

Profitability

Net income for the period increased to $1.08 billion from $1.7 billion the year before. The decline was mostly caused by declining revenue and rising interest costs. Despite a challenging macroeconomic environment, the net margin remained stable at 7.2%, indicating moderate profitability.

What’s happening with CNH now?

The company is investing a lot of money in the future. For instance, it just acquired Hemisphere for its satellite navigation technologies. These developments are consistent with current agricultural trends toward increased efficiency and sustainability. However, as is often the case, the returns on these investments are gradual.

Risks and Challenges

Revenue decline: Declining sales in important markets, such as construction and agricultural equipment.

Macroeconomic factors: Inflation and rising interest rates could put pressure on profits.

High amounts of debt: In the face of fluctuating revenue, borrowed funds reduce financial flexibility.

Only my opinion:

In my view, CNH’s stock is a bet on patience. Yes, the revenue decline and high debt are concerning. But the prospects for automation and precision farming are exciting. If you’re willing to weather short-term challenges, these shares could become an intriguing addition to a long-term portfolio.

Short term? Stay away for now. With an RSI of 91.93, the stock looks overbought, and a pullback seems inevitable. I’d wait for a range of $11.50–$12.00 to enter.

Long-term? Hold onto these shares despite market swings if you have faith in their technology and tenacity. Who knows, they might be trading at $16 in a few years.

But keep in mind that there are hazards associated with investing. Pay attention to quarterly reports and remember the most important question: are you prepared to wait?