Tyson Foods: Giant of Protein or a House of Cards?

Analyzing the Strengths, Risks, and Growth Potential of a Global Food Leader in a Challenging Market

Today, we are reviewing Tyson Foods, Inc. (TSN). What caught my attention is its reputation as a global leader in protein-based food production. Meat indeed rules the world, but reputation alone doesn’t guarantee investment success. In fact, more often than not, nothing does—just think of the recent launch of a famous coin by a big-name individual, you know what I mean. While Tyson is undoubtedly a strong company, it doesn’t operate in a vacuum. Let’s dive into the numbers to see what it represents today and whether it has what it takes to withstand market pressures.

Read this first

Financial reports Tyson Foods

Tyson, headquartered in Springdale, Arkansas, is a brand well-known in many American households, thanks to names like Tyson, Jimmy Dean, and Hillshire Farm.

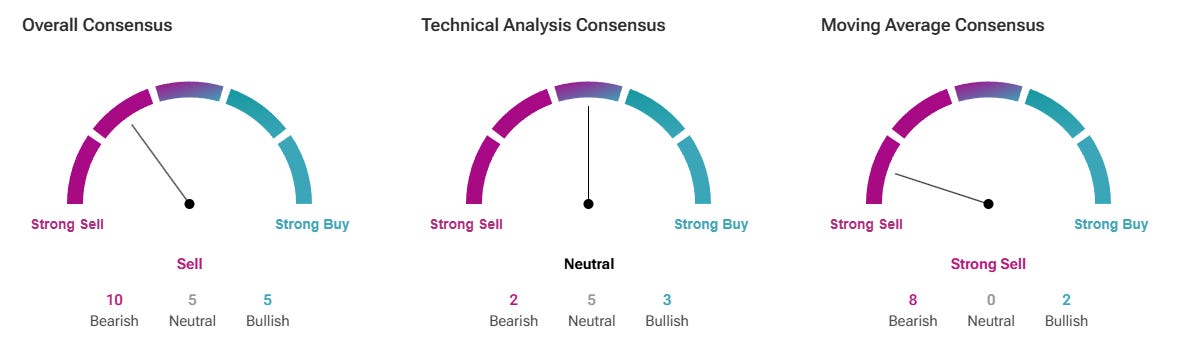

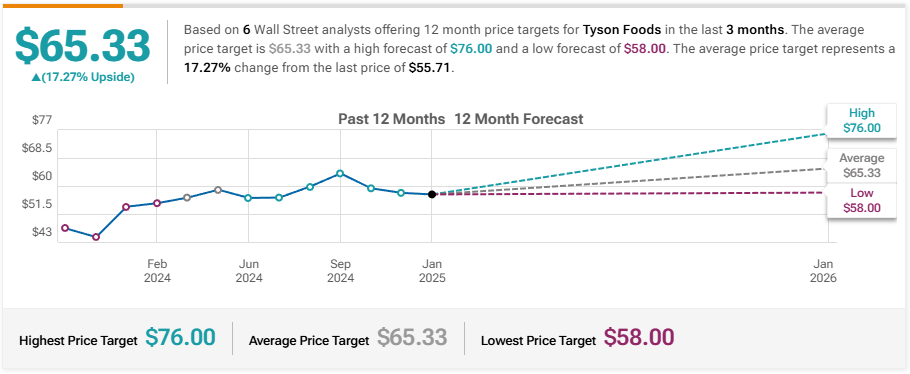

Tyson shares were trading at $55.71 on January 20, 2025, roughly 16% below their 52-week high of $66.36. Statistics suggest that the company's PEG ratio is only 0.45, indicating that it is undervalued. However, we should not believe everything we hear. An RSI of 35.71 indicates that the stock has been oversold, whilst a negative MACD (-1.33) indicates that momentum is weak. Feeling the contradiction here?

Risks and Potential Surprises

The company faces issues that concern me. Take, for example, rising raw material costs. Imagine chicken feed prices jumping 20%. Who pays for that? You, the consumer. And we already are. Add inflation, labor shortages, and the growing popularity of plant-based proteins, and the picture gets even more complicated.

On the flip side, Tyson is not sitting idle. They are actively expanding into international markets and investing in innovations, including alternative protein production. For instance, their Tyson New Ventures investments have already shown results. But this alone won’t be enough.

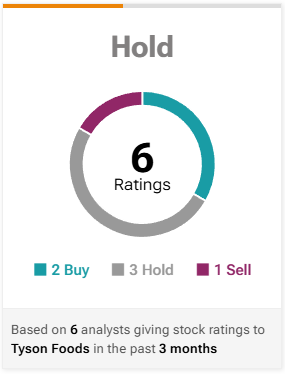

My Take on the Stock

I always ask myself, "What am I getting in the long term?" Tyson, with its P/E ratio of 24.76, might seem overvalued. But looking deeper: an EPS of $3.50 with projected earnings growth of 55.56% is something to consider. Plus, their dividends are decent.

In my view, the $54–$56 range could be a good entry point for cautious buyers. But don’t forget to set a stop-loss at $53 to limit risks. A friend of mine once "forgot" to set limits and lost more than he could afford. Learn from others' mistakes—or don’t. No one cares.

Revenue

Let's agree that $53.2 billion in sales by 2024 seems impressive. Tyson Foods is based on four key pillars: beef, hog, poultry, and prepared foods. Interestingly, poultry and prepared foods not only held steady but also remained stable in a year when raw material prices were as erratic as a rollercoaster. Could this be their secret?

Profitability

Here, things are less rosy. On one hand, the beef segment suffered due to rising cattle prices. On the other, chicken performed well: the company managed to cut feed costs and improve operational processes. And pork? Margins improved slightly due to efficiency gains. However, inflation and price wars with competitors impact overall profitability. The big question is: how long can they withstand this pressure?

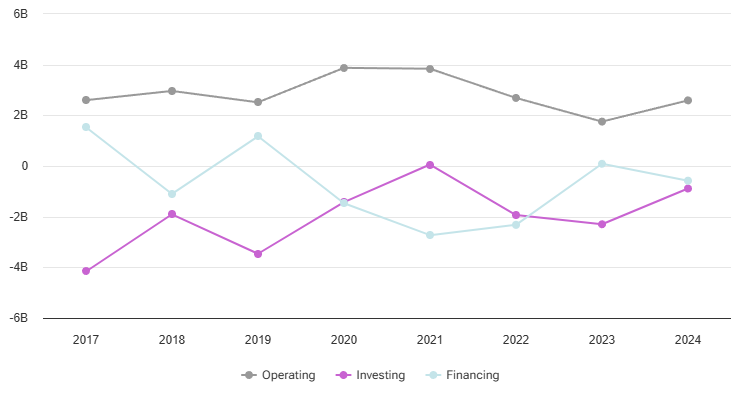

Cash Flows

Whoever manages Tyson’s working capital deserves a handshake. Operating cash flows are stable. But not everything is perfect: facility upgrades and innovations demand significant investments, putting free cash flow under pressure, even if it remains positive. And the debt? There’s enough of it to keep them on their toes.

Balance Sheet

A review of the financial statements demonstrates that the company is on solid ground. Sure, $13.9 billion in goodwill and intangible assets, or 37% of total assets, creates issues. However, long-term debt is massive, and $158 million in unfunded pension payments adds to the problem.

Insiders are Positive Buying More Shares Than They Are Selling In Tyson Foods Inc

In the last 100 trades there were 2.64 million shares bought and 1.22 million shares sold. The last trade was made 65 days ago by King Donnie who bough 45.61 thousand shares. The large amount of stocks bought compared to stocks sold indicate that the insiders believe there is a potential good upside. In some cases larger purchases can be explained by due date for stock options.

Growth Areas

Prepared Foods: The world is speeding up, and the demand for “meals in 5 minutes” is growing.

International Expansion: Asia and the Middle East are ripe for growth.

Innovations: Alternative proteins? Sustainable solutions? This is the future. Imagine their innovative products hitting store shelves worldwide in a few years—what a growth driver that would be!

Risks and Challenges

But there are dark clouds too: Raw Material Price Volatility: Rising feed costs eat into margins.

Regulatory Changes: New food safety laws could become a headache.

Customer Concentration: Walmart accounts for 18.4% of Tyson’s sales. This dependence is concerning. One major client can make or break a company.

Labor: Retaining employees is becoming harder, and wages are rising.

This begs the question: can Tyson find a balance between these challenges and opportunities?

Personal Opinion

Looking at Tyson through the lens of the coming year, they seem like a stable choice. Their focus on innovations and international markets could play to their advantage. But keep an eye on raw material prices and their reliance on key clients like Walmart. Their current valuation and dividends are appealing, especially for those seeking portfolio balance. Still, it feels like behind this stability lies a challenge the company has yet to resolve. Will this be a story of resilience—or missed opportunities?