UiPath: A Chance for 40% growth or a Road to Nowhere?

Strong subscription growth, but a weak balance sheet, legal disputes, and operating losses — are you ready to take the risk?

Today I came across an article recommending buying UiPath (Ticker: PATH) stock with a 40% growth potential. Tempting, of course, but looking at the chart, I realized we need to dig deeper, because it’s frankly weak. I delved into UiPath’s financial report and here’s what I found.

Read this first:

Financial report UiPath

Usually, when you see such data, the question arises: does the company even know where it’s headed? Just think about it: at this stage, they’ve decided to repurchase their shares for some reason. Let’s go through the numbers.

1. Revenue

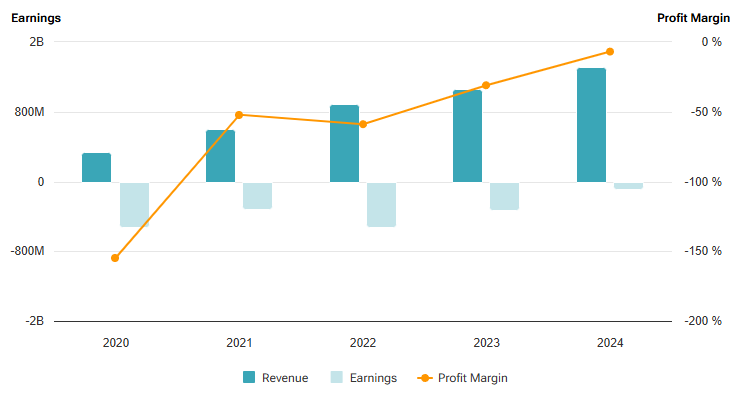

Here’s what we’ve got: total revenue for the first 9 months of 2024 reached $1.006 billion — an 11.4% increase year-over-year. However, license revenue fell to $389.55 million (down 2.96%). Why is this segment, which is key for the company, showing a decline? Perhaps they’re losing major clients or can’t offer anything truly innovative. That’s a bad sign, though it’s just my assumption for now.

Meanwhile, subscription services grew to $586.73 million, up 23.8%! It seems the transition to a recurring revenue model is working. But here’s another question: will this become the only growth area the company relies on? Other segments, like professional services, grew just 8% — to $29.74 million.

2. Profitability

This is where things get puzzling. Gross profit stood at an impressive $823.61 million, with a margin of 81.9%. Sounds good, right? But operating losses increased to $196.18 million. Why? The answer is simple: massive spending on marketing, sales, and R&D. R&D alone consumed $281 million — a 14% increase year-over-year. Is this normal if profitability continues to suffer? Doesn’t this resemble a situation where a company tries to buy its future at the expense of the present?

3. Cash Flows

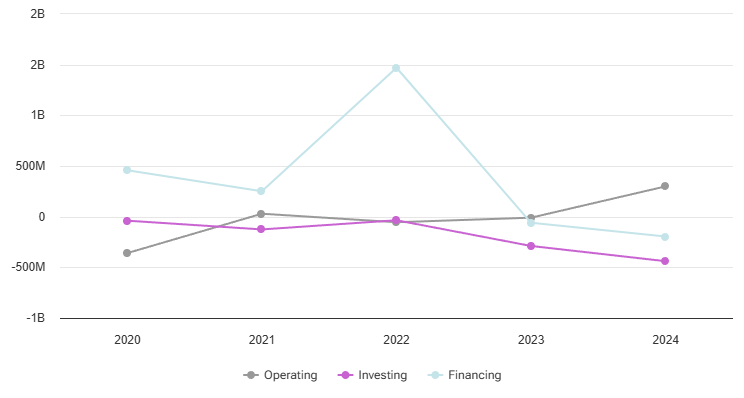

On the one hand, operating activities brought in $174.48 million, more than last year’s $153.48 million. Sounds optimistic, right? But digging deeper — the company spent $433.53 million on stock buybacks. Why? To support the falling market price? To me, such actions always seem like an attempt to mask internal problems.

4. Balance Sheet

The company holds $773.63 million in cash, while its debts amount to $931.45 million. Sure, the debt-to-equity ratio of 0.54 isn’t disastrous, but still. What happens if costs continue to rise at this pace?

5. Growth Areas

Subscription services are the star of the show. A 23.8% growth rate indicates strong customer interest. Additionally, revenue in EMEA regions grew by 16.6%, and in APAC by 7.3%. But you know what’s concerning? 48% of revenue still comes from the Americas. This feels like walking on thin ice: if demand in the region drops, the company could face a serious blow.

6. Risks and Challenges

Let’s take a closer look here. The company is involved in several lawsuits, including securities-related cases. Some claims allege the provision of misleading information. This is a direct hit to reputation! And what about the tax disputes in Romania? Who knows how much they’ll cost.

Competition isn’t asleep either. Microsoft, ServiceNow, and other players are ramping up pressure. Add to this the enormous spending on research and restructuring (layoffs cost $15.7 million), and it’s clear the company faces a challenging period ahead.

And a little more. In the last 100 trades there were 1.84 million shares bought and 2.9 million shares sold. The last trade was made 11 days ago by Ramani Hitesh who sold 37.15 thousand shares. In general the insiders are selling more stocks than they buy. There can be a variety of reasons for this, but in general it can be considered as a negative signal.

7. My Opinion

If I were considering UiPath for a 1-year investment, honestly, I wouldn’t rush. Yes, revenue growth is impressive, especially in subscription services. But losses and rising operational costs are a red flag. It might be worth waiting for operational efficiency to improve. Or, alternatively, entering the stock at lower levels, say $10–11.

UiPath is like a racer striving for the finish line, or perhaps more like a taxi driver trying to make money with a rented car, while the car itself is already smoking. The potential is there, but you need to be ready for the risks.

What do you think — will they live up to expectations? Maybe.

Danger ZONE

Current Price: $12.97 (01/13/25)

52-Week High/Low: $27.87 / $10.37

P/E Ratio: -81.06 (negative earnings)

Forward EPS: $0.44

PEG Ratio: 0.22 (suggests undervaluation if growth materializes)

Short-Term Investment Strategy

Current Signal: Hold. RSI is at 50, indicating no strong momentum.

Entry Point: $12.50 (near support level).

Exit Point: $14.50 (near resistance).

Short-Term Outlook: Bearish to Neutral. Weak demand in core markets and competitive pressures limit immediate upside.

Long-Term Investment Strategy

Potential: High if UiPath successfully pivots into agentic AI and builds a competitive moat.

Risks: Intense competition, lack of profitability, and potential dilution due to stock-based compensation.

Suggested Buy Zone: $10.50$12.00.

Suggested Exit Zone: $20.00$25.00 if the company achieves sustainable growth.

Long-Term Outlook: High Risk, Moderate Reward. Patience is required as the company works to prove its AI edge.

Risk Assessment

Valuation: Negative earnings make valuation tricky. Forward PEG of 0.22 looks attractive, but execution risk is high.

Competitive Pressures: Giants like Microsoft and Salesforce are integrating AI into their platforms, potentially squeezing UiPath.

Profitability Concerns: Operating losses and reliance on stock-based compensation dilute shareholder value.

Market Sentiment: Sluggish demand in key geographies like Europe and North America.

Investment Thesis

UiPath is a company with strong technological foundations but faces significant headwinds. The transition to agentic AI could open new revenue streams, but the competitive landscape is fierce. The stock is speculative and suitable for investors with a high-risk tolerance who believe in the long-term automation story. Near-term profitability remains elusive, making this a risky bet.

Given its current valuation and technical indicators, a cautious approach is warranted. Traders may consider swing trades within the $12.50$14.50 range, while long-term investors should wait for a pullback to below $12.00 before initiating a position.