Upwork: The Evolution of the Freelance

The focus on AI and subscriptions unlocks growth potential.

Upwork (UPWK), which serves as a kind of "Uber" for professionals in marketing, finance, IT, and even customer care, is arguably the most well-known freelance marketplace. In recent years, the company has focused on artificial intelligence, automated talent matching, and improved its capabilitiesClients find suitable freelancers faster, and freelancers receive more relevant job offers. Is it effective? Although it's not quite there yet, the potential is clear.

Read this first:

Financial report Upwork.

The New Standard for Remote Work

Working remotely has become the new standard on a worldwide scale. Big businesses are increasingly using independent contractors, and Upwork is one of the main winners of this trend.For example, over the last 12 months, the proportion of AI-related job postings has risen by 60%.This is a noteworthy figure, and the trend is probably going to keep becoming stronger.

Upwork has made a significant technology investment with the introduction of Uma, an AI assistant that makes work more productive for both clients and independent contractors.

Key Numbers

P/E Ratio: 25.05

52-Week High/Low: $18.14 / $8.43

Growth Rate: 87.1%

PEG Ratio: 0.29 – It seems the market has not fully priced in the company’s potential.

Revenue is increasing, but not at a faster rate.

Q4 2024 revenue: $191.5M (+4% YoY)

Sales in 2024 were $769.3 million, a 12% increase over the previous year.

The numbers are not very noteworthy, but they are fair. A quarterly growth rate of 4% is not out of the ordinary.

The number of customers and the growth of AI services are the primary factors.

This increase does not appear to be exponential at this time, even though the subscription and AI wager may be successful.

Profitability: A Phenomenal Profit Surge

Q4 2024 Net Income: $147.2M (but note the tax benefits)

2024 Net Income: $215.6M (+359% YoY)

2024 EBITDA: $167.6M (+129% YoY)

EBITDA Margin in Q4: 26% (a record for the company)

This section looks much more interesting. Such profit growth is extraordinary. Of course, without tax benefits, the results would be more modest, but even without them, Upwork has significantly improved its profitability. The key factors are cost optimization and subscription revenue growth. Does this mean the trend will continue? That remains an open question.

Cash Flows: The Business Is Now Producing Actual Profits

Operating Cash Flow for 2024: $153.6 million (+191% YoY)

2024 FCF (free cash flow): $139.1 million, up 253% year over year

Balance sheet cash: $305.8 million

One of the most important metrics, it appears to be quite strong. A company is doing well if it makes money instead of just depending on investments. Although Upwork has the means to expand further, it is unclear how they will put those resources to use.

Balance Sheet: Stable, but Debt Remains

Total Assets: $1.2B

Total Debt: $357.9M

Net Cash Position: Positive

The company’s financial position has improved, but the debt remains significant. While $357.9M is not a disaster, if the market slows down, repaying it could become more difficult. The key question is how effectively the investments funded by this debt will perform.

Growth Areas: AI and Subscriptions as the Future Bet

AI Services Revenue Growth: +60% in 2024

Subscription Revenue Growth: +58% YoY

Corporate Segment: Upwork Business Plus is actively gaining clients

It seems sense that the corporation is concentrating on AI and subscriptions. AI solutions enhance the usability of the platform by automating matching and saving time. By providing a steady revenue stream, subscriptions reduce dependence on one-time purchases. Even though both industries seem promising, it's still uncertain if Upwork will be able to compete.

What Could Go Wrong?

Competition: Toptal, Fiverr, and others aren't staying the same

Macroeconomics: Businesses may reduce freelance expenditure during a crisis.

Rules: Possible modifications to European and American laws governing freelancing

Although Upwork is in a solid position right now, the freelance business is very changing. For example, Toptal is drawing in higher-paying customers, while Fiverr is aggressively growing its ecosystem. The number of active clients is dropping, which is another significant problem. 832K clients are now active, which is 2% less than a year ago. It is important to remember this.

In the last 100 trades there were 505.03 thousand shares bought and 858.88 thousand shares sold. The last trade was made 16 days ago by Nelson Elizabeth A who bough 32.62 thousand shares.

Additionally, an economic downturn could reduce demand for freelance work. And then there’s legislation—both the U.S. and Europe are already discussing stronger protections for freelancers, which could increase costs for companies.

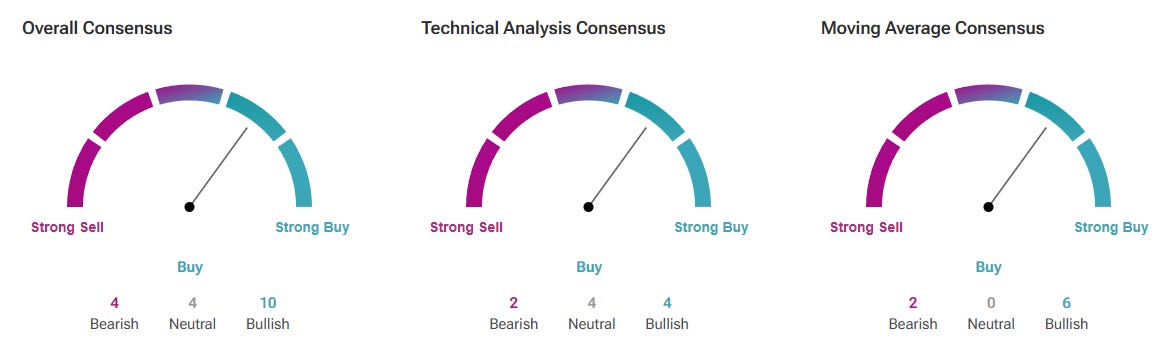

Trading Strategy

Short-Term Strategy:

Entry: $14.75 (support level)

Exit: $17.20 (resistance level)

Stop-Loss: $14.50 (high volatility, better to play it safe)

Long-Term Strategy:

The current price looks attractive for long-term investors, especially considering the PEG of 0.29.

Investment Horizon: 3–5 years (betting on AI expansion and corporate segment growth)

Key Risks: Macroeconomic instability, rising customer acquisition costs, and declining user activity.

Should You Buy?

Upwork looks strong—revenue is growing, profits are soaring, and free cash flow is hitting record highs. What’s particularly interesting is how the company is developing its AI segment. The key question is whether it can sustain this momentum.

If the goal is long-term investment rather than short-term speculation, the stock looks attractive.

It is worth buying only if you are ready to hold the stock for several years and believe in AI development.