The U.S. stock market lit up in spectacular fashion: what began as a day of uncertainty and plunging futures ended with one of the most impressive rallies since the 2008 financial crisis. A historic surge was triggered by President Donald Trump’s announcement of a 90-day suspension of reciprocal tariffs for 56 countries — a move that instantly reversed investor sentiment and sparked a powerful risk-on momentum.

U.S. indices posted explosive gains:

S&P 500 closed up +9.52%

Nasdaq 100 skyrocketed +12.02%

Dow Jones Industrial Average gained nearly +3,000 points or +7.87%

The core reason behind the rally was Trump’s surprise 90-day tariff pause for most U.S. trading partners, excluding China. The move came amid:

A sharp rise in U.S. Treasury yields

Market chatter about foreign investors dumping U.S. assets

A plunge in the Chinese yuan to a 17-year low

Tariffs on Chinese goods were actually increased from 104% to 125%, escalating tensions with Beijing. However, the softening of measures toward other nations was interpreted as an attempt to stabilize U.S. geopolitical alliances and calm fears of a full-blown economic conflict.

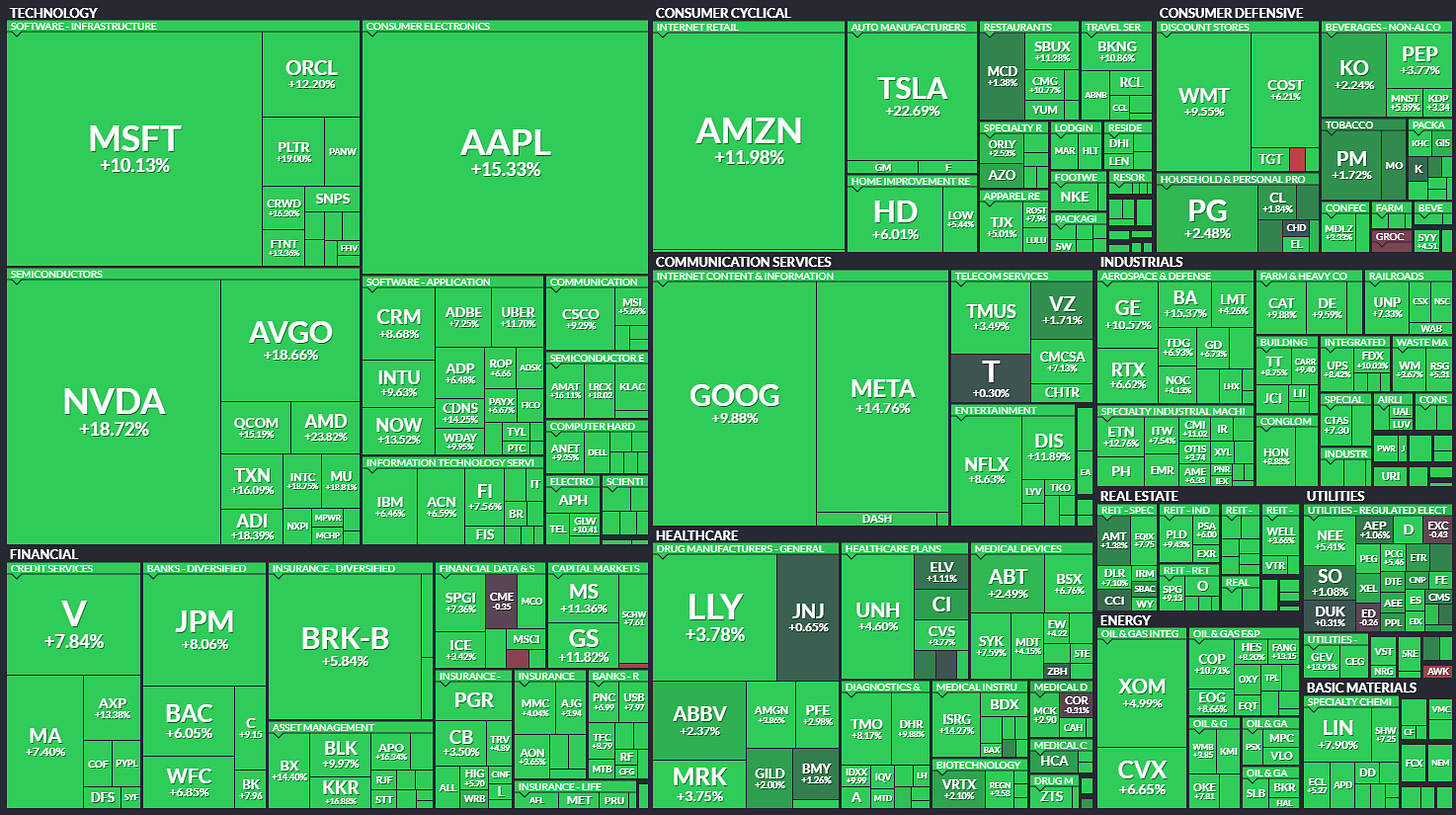

The tech titans — the so-called Magnificent Seven — led the market’s rebound:

Tesla: +22%, as optimism surged in the EV sector

Nvidia: +18%, following a halt on GPU export restrictions to China

Apple, Meta, Amazon, Microsoft, Alphabet: each gained +9% to +16%

Semis staged one of the strongest sectoral rallies:

Microchip Technology, ON Semiconductor, AMD, ARM, Broadcom and others rose +18% to +27%, driven by expectations of renewed demand and potential easing of China-related restrictions.

With crude prices rising over 4%, energy names surged:

Devon Energy: +15%

Halliburton, Occidental, Schlumberger: +11% to +14%

Phillips 66, ConocoPhillips, Valero Energy: solid gains across the board

Tourism and entertainment stocks staged a long-awaited comeback:

United Airlines, Delta, Carnival, Royal Caribbean, Expedia: +14% to +26%

Relief from tariffs lowered cost pressures for global operators

Inflation & Growth Risks Loom

FOMC minutes revealed growing concerns over inflation and weakening labor conditions. The Fed signaled it’s unlikely to cut rates in the near term — even if the economy slows — due to inflationary risks linked to tariffs.

U.S. Treasuries sold off sharply.

The 10-year yield surged to 4.511%, a six-week high.

Confidence in U.S. fiscal stability is being tested amid fears that countries like Japan or China may begin liquidating U.S. debt.

Markets are now looking ahead to several key events:

Thursday: March Consumer Price Index (CPI) data

Friday: Start of Q1 earnings season with major banks reporting

PPI data and University of Michigan sentiment index to follow

Trump’s 90-day tariff break isn’t a resolution — it’s a temporary breather. But the market response underscores how desperately investors crave clarity and cooperation.

It remains to be seen whether this moment marks a turning point or merely a pause before new escalation. All eyes are now on Washington, Beijing, and the Fed.